In my first post of this series, I introduced how the combination of behavioral finance and automatic plan features is reshaping retirement outcomes.

In my second post, I presented you with compelling research and evidence on the behavioral and psychological barriers to saving and projected retirement income replacement rates.

And in my third post, we started to take a hard look at the data around automatic plan features and how pulling these levers as a plan sponsor can get people on the path to retirement success.

In this fourth and final post of the series, I want to take a look at participant investing trends and keys to successfully implementing an automatic features program for your plan.

In combination with implementing automatic enrollment, it’s necessary to choose a default investment option, such as a target-date fund, a managed account, or a balanced fund for participants. This is what’s known as a Qualified Default Investment Alternative (QDIA). With target-date funds projected to capture nearly 90 cents of every dollar contributed annually to 401(k) plans by the end of 2019, I believe this is the single most important investment decision you will make for participants. It’s also important to recognize participant investing trends. Despite the considerable efforts to make people better DIY investors, the evidence suggests it’s neither worked very well in the past or today.

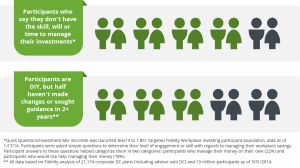

According to a Fidelity survey, 8 of 10 participants said they didn’t have the skill, will, or time to manage their investments. And yet, upon further analysis, 6 of 10 participants were invested as a do-it-yourselfer (DIYer) but hadn’t sought guidance or made changes to their portfolio in 2+ years. Clearly, there is a major disconnect which is why many DIYers have unsuccessful investment experiences.

In my book, Fixing the 401(k) that I wrote in 2008, I cited a longitudinal study conducted by Burgess Associates from 1997-2006 that compared the returns of approximately 15,000 participants who did it themselves versus those who used a “professionally managed option” like a lifestyle fund or a target-date fund. Those in the professionally managed options earned 1.9% higher returns per year over the 10 year period than DIYers and ended the period with an average of 11% higher account balances. Also, nearly 85% of DIYers would have been better off in a professionally managed portfolio.

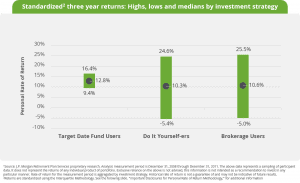

The data below from J.P. Morgan covering the period from 2008 to 2011 is just as compelling. Most investors get themselves in trouble by doing the wrong thing at the wrong time, usually exacerbated in periods of market volatility and stress. I believe this time period is illustrative because it incorporated The Great Recession.

J.P. Morgan evaluated target-date fund investors across their client base during this challenging time period compared to DIYers using core menu funds and self-directed brokerage. There’s a couple of important things to highlight here.

First, on average, target-date fund users had returns of more than 2% higher per year during this period than DIYers. More importantly, from my perspective, look at the range of returns. While the most successful DIYers and brokerage users had higher returns, the least successful investors struggled mightily. Alternatively, the range of returns for TDF users was much tighter, and those investors on the low end still had a very successful experience.

I like to use the analogy about TDFs when I once took my daughter to a kindergarten birthday party at a bowling alley. You see, the bowling alley was smart. To ensure all the kids would have a fun and successful experience, they put up bumpers so the kids wouldn’t throw gutter balls. Instead, the kids had a great time because they were knocking down pins left and right. As soon as we got in the car, my daughter said she wanted to have a bowling birthday party. Score one for the bowling alley owners (especially given how expensive it is to bowl these days)!

Our philosophy at Greenspring Advisors is to engineer your 401(k) or 403(b) plan in every area (e.g., plan design, fees, investments, etc.), with your least sophisticated employee in mind and to do all you can to keep them from throwing the proverbial “gutter ball” with their retirement savings. I believe that target-date funds, while not a perfect solution or the right option for everyone, is the best possible investment solution for the vast majority of participants, who are most likely to be disengaged at some level.

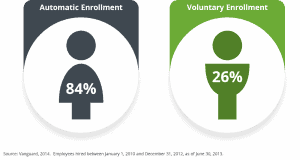

According to Vanguard, only 26% of participants in a voluntary enrollment plan utilize the default option properly, which means investing 100% of their balance and contributions into a single option. In contrast, nearly 85% of participants utilize the default option correctly when automatically enrolled, again going back to behavioral inertia.

Once you identify the right target-date fund for your plan, you should engineer the plan in a way that creates a high probability that 90% or more will be invested this way. We’ve got an effective strategy for accomplishing this, which essentially re-enrolls all your participants into the target date fund matching their retirement date unless they are opt-out. Again, it sounds like a strategy that probably moves you out of your comfort zone slightly, but it’s a growing trend and one definitely worth discussing. Communicated effectively, it’s typically both an effective and appreciated process by participants and a non-issue for the vast majority of people, especially when presented with the data we just looked at.

So now that I’ve walked you through the compelling evidence and research let’s highlight how to bring it all together. The key to the successful adoption of an automatic program that gets your participants on the path to retirement success is all in how you implement it. Here are 6 strategies to get you started:

I hope you’ve enjoyed this series about using behavioral finance to drive retirement outcomes. If you want to learn about how Greenspring Advisors can help help you take your retirement plan to the next level, please let us know.