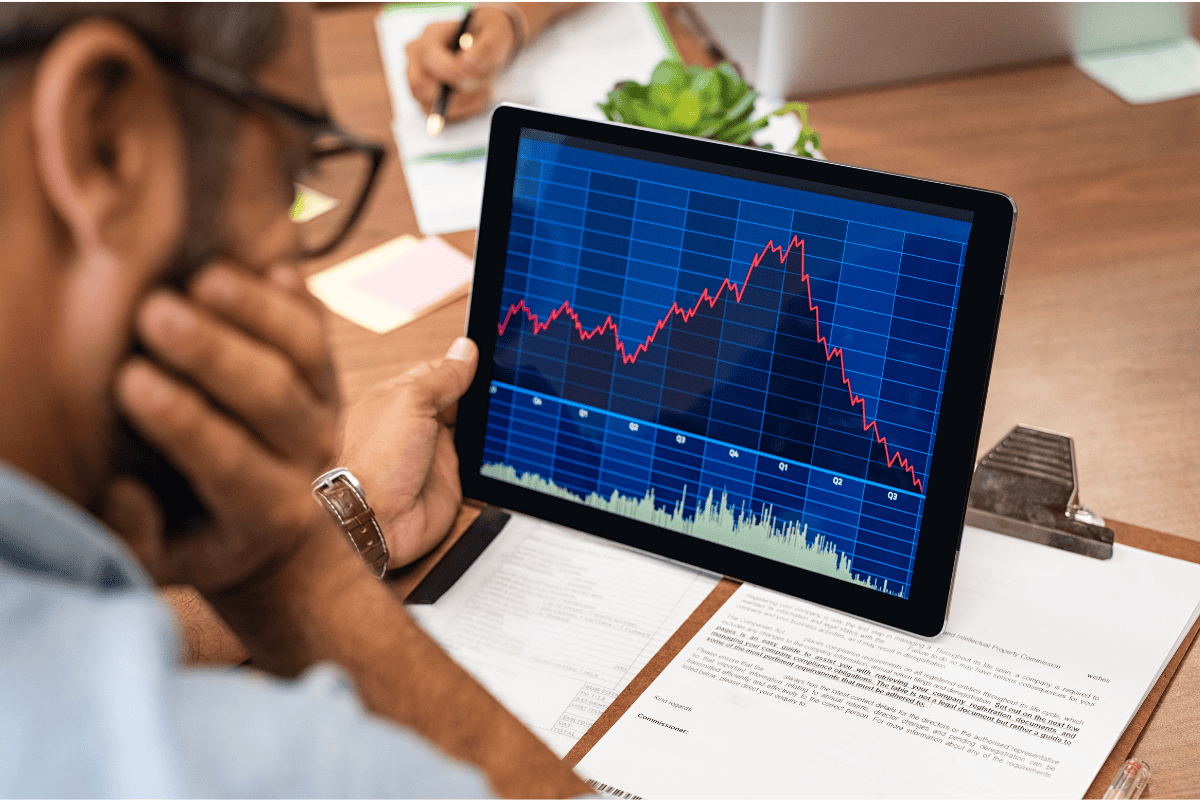

For 2022, it may feel like the theme has been “nowhere to hide.” As this is written, the year-to-date performance of stocks is ¹ –22.17% and typically stable bonds ² are -13.54% through 9/22/2022.

So, what is going on? While no one knows for sure what drives the stock and bond market in the very short-term, I think it is safe to say there are a few issues that are weighing on investors’ minds:

• Inflation and interest rates – In an effort to curb the hot inflation readings we are seeing, the Federal Reserve is in an all-out battle to slow down growth. As they raise short-term interest rates, it is having an impact on things like mortgages, car loans, and other lending instruments. The thinking is that when the cost to borrow goes up, economic growth will slow, and inflation will come down. There is some evidence that this may already be starting. Inflation figures month-over-month have leveled off.

• Geopolitical concerns – While the war is still raging in the Ukraine, Russia has announced its intention to call up an additional 300,000 reserves, which appears to be an escalation. When tensions increase, the probability of a misstep increases.

• Growth concerns – With the Fed raising rates, and prices elevated, there is a concern that growth could slow in the future. One glaring example is real estate. With home prices still near all-time highs, and mortgage rates nearly double from where they were 2 years ago, there could be price adjustments to reflect the current reality. In addition, slowing growth increases the odds of a recession, which seems to be top of mind for many investors.

While there may seem to be countless stories of bad news, there are some real positives that investors should be considering at this point. First, all the information I’ve listed above is well known. Stock prices have already dropped over 20% in anticipation of all the bad things that are coming. Remember, the markets don’t care about good or bad (that’s already priced in), only better or worse. With that being said, there are some bright spots to consider for investors who have cash on the sidelines or are wondering what to do with their current holdings:

1) Bond yields are at the highest they’ve been in 12-15 years – Current bond holders are now earning income at yields they haven’t seen in over a decade. For many investors who have become accustomed to bond yields of 1-2%, the new yields of 3-5% are welcome news for the future.

2) Stock prices look attractive relative to earnings – The forward Price-to-Earnings ratio of the world stock market is currently at 14.6 ³ , putting it right in line with its 25-year average. While this metric tells you almost nothing as to how stocks will perform in the short-term, you can take some comfort that stock prices are priced near their historical averages as they relate to earnings.

We like to think about losses in the market as “temporary declines.” Because that’s what they have always been (except for investors who sell when the market is down). This volatility is what allows us to earn high expected returns (if there was no risk, there would be no additional return). We know the ups and downs of the market can be stressful, and that’s where we come in. As a reminder, all of Greenspring’s (k)larity @ work™ financial wellness tools and resources can be accessed by visiting www.greenspringadvice.com.

Greenspring Investment Committee