The stock and bond markets have been struggling in 2022. We thought it would be helpful to provide an explanation regarding what has been happening, how to think about these issues, and what we are doing about it.

Markets are hard to explain. Turn on the TV and you will find pundits telling you exactly why the market goes up or down on a given day. The honest answer is that no one really knows why the market moves in a certain direction over the short-term. Over the long term, we feel confident to say that stock prices are impacted by earnings and views about the future (often expressed through how cheap or expensive a stock or the market is). As of May 13, stocks are down around 16% for the year[1]. Earnings projections have not changed much, so the market participants seem to have a more negative outlook on the future than they did a few months ago. Why is that? We can think of a few reasons:

- Rising inflation

- The Federal Reserve signaling a tightening (increase) of interest rates

- Geopolitical risk, specifically the war in Ukraine

We’ll talk about this from a historical perspective in a moment, but these events/issues are also having a profound impact on the bond market. The US bond market is off to its worst start in the last 180 years (yes, they apparently have data that goes back that far!). Interest rates are inversely correlated to bond prices, so the spike in rates has caused a selloff in bonds that we haven’t seen in our investing lifetimes (stay tuned for the silver lining here).

So how should we think about the issues we are facing?

First, it is important to note that this drop in the stock market is completely normal. It is also normal to be anxious and fearful when we go through one of these periods. On average, the stock market sees losses of 14% at some point, and recently, during the depths of COVID, the stock market lost about 35%. When you look at it from a short-term perspective, these are scary times. But we have seen losses like this before (and much worse). What has been true every single time in the past is that the only people that lost money during those periods, were the ones who sold.

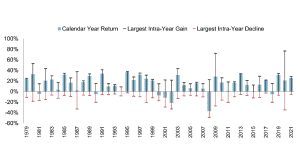

This is one of our favorite charts showing both actual returns of the Russell 3000 every year since 1979 along with the worst intra-year declines and largest intra-year gains. It shows how common market volatility is (the average intra-year decline has been 14% each year), and what we must stomach to earn the phenomenal returns equities have provided.

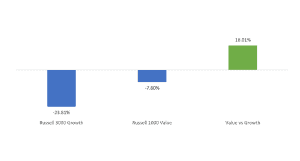

Second, not all stocks have behaved the same. Stocks that are expensive relative to their earnings are called growth stocks (think Tesla, Google, Facebook, etc.). When inflation was anemic and growth was hard to find, people were willing to spend higher and higher amounts on these companies, pushing valuations to extremes. As inflation has rapidly accelerated, growth stocks are being repriced to reflect the new reality. To put it in perspective, the Russell 3000 Growth index, probably the best benchmark for these stocks, is down 24% so far this year and the Russell 1000 Value is only down 7.8%. That is why it is so important to have a diversified portfolio.

Finally, bonds may be the biggest disappointment this year. This asset that is supposed to provide balance to the portfolio, especially when stocks are falling, has failed to perform. The Bloomberg US Aggregate Bond Index is down 10% year-to-date, the worst start on record for this index. So, is this a time to bail out on bonds? We don’t think so. Even more so than stocks when bonds go down, their future expected return goes up. As long as you are buying a credit-worthy bond that does not default, that statement is a mathematical fact since bonds have set maturity dates and values. If a bond drops from $1,000 to $900, and we know it is going to mature in the future for $1,000, the drop in price just means that future returns will be higher. Those higher returns are manifesting themselves in the form of higher interest rates. In the past where you may have been lucky to generate a 2% yield on bonds, we are now seeing 3 or 4% returns. This is great news for savers as you are finally getting some decent yield on your safe investments. Conversely, if you are planning on borrowing money (mortgage, car, student loans, etc.), higher rates mean higher interest payments.

So, in the light of all this turmoil what should we do?

First, it is almost never a good idea to make changes to your portfolio considering “events” happening in the markets. That’s because markets tend to be efficient. They price these events and the potential outcomes into prices very quickly. So, in this case, the market has already priced in the anticipation of future rate hikes by the Fed. You wouldn’t want to buy or sell because of those likely future events…it is already reflected in stock prices.

But that doesn’t mean you should do nothing. We think periods of market volatility create opportunities to add value to portfolios. In your company retirement plan, focus on what you can control:

- Maintaining a diversified portfolio

- Rebalance your account to ensure your plan meets your risk tolerance

- Maintain perspective, stay disciplined, and focus on the long-term

While the actors may have changed, we have seen this play before. In fact, drops like this are so common, on average they happen about once every year. Whether it be the tech boom/bust, 9/11, the Great Recession, COVID, or this current volatility, we believe that markets will do what they have always done…. reward patient, long-term investors. Despite the recent events, humans always look to improve, and owners of companies are the benefactors of that improvement through increasing cash flow and rising stock prices. We remain optimistic about better days ahead.

For Additional Information & Professional Advice

Please feel free to visit Greenspring’s financial wellness + fiduciary guidance platform, (k)larity @ Work, by visiting www.greenspringadvice.com.

Remember, you can always schedule a 1:1 meeting with a CERTIFIED FINANCIAL PLANNERTM at Greenspring Advisors. or you can call our advice hotline at 833-552-7489.

Greenspring Investment Committee

[1] Data from Morningstar Advisor- Russell 3000 Index (USD, TR) through 5/13/2022