The IRS recently released a report with some interesting data on income trends in America. As you would expect, it takes a lot to get in the top 1% of all taxpayers. Here are some of the stats:

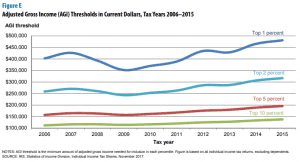

You need to earn $480,930 to be in the top 1% of all US taxpayers. If that seems high, you’re right. In 2009 you “only” needed to earn $350,000 to be in the elite 1%. The last several years have been kind to the wealthy. So, what does this really mean? Not much. It may help track your own income against the increases and decreases across the US taxpayer base, but that is about all it is useful for. It doesn’t tell you what assets they have accumulated. It doesn’t tell you how much they can save each year. And it doesn’t tell you if they are on track to accomplish their goals.

From an ego standpoint, we all probably want to be in the top 1%. But we should be focused on different numbers that are more custom to us. What is the probability that I am going to achieve the goals I want to accomplish? How much should I be saving each year? Comparing yourself to others is a recipe for disaster. Develop a custom plan for you and make sure you follow it.