In my first post of this series, I introduced the concept of how the combination of behavioral finance and automatic plan features are reshaping retirement outcomes. And in my second post, I presented you with compelling research and evidence on the behavioral and psychological barriers to saving as well as projected retirement income replacement rates

So hopefully I’ve made the case that we’ve got a retirement savings crisis, that people just aren’t wired to save effectively, and that savings rates need to be much higher to make the arithmetic work. Let’s transition the discussion and start looking at the data around automatic plan features and how pulling these levers can get people on the path to retirement success.

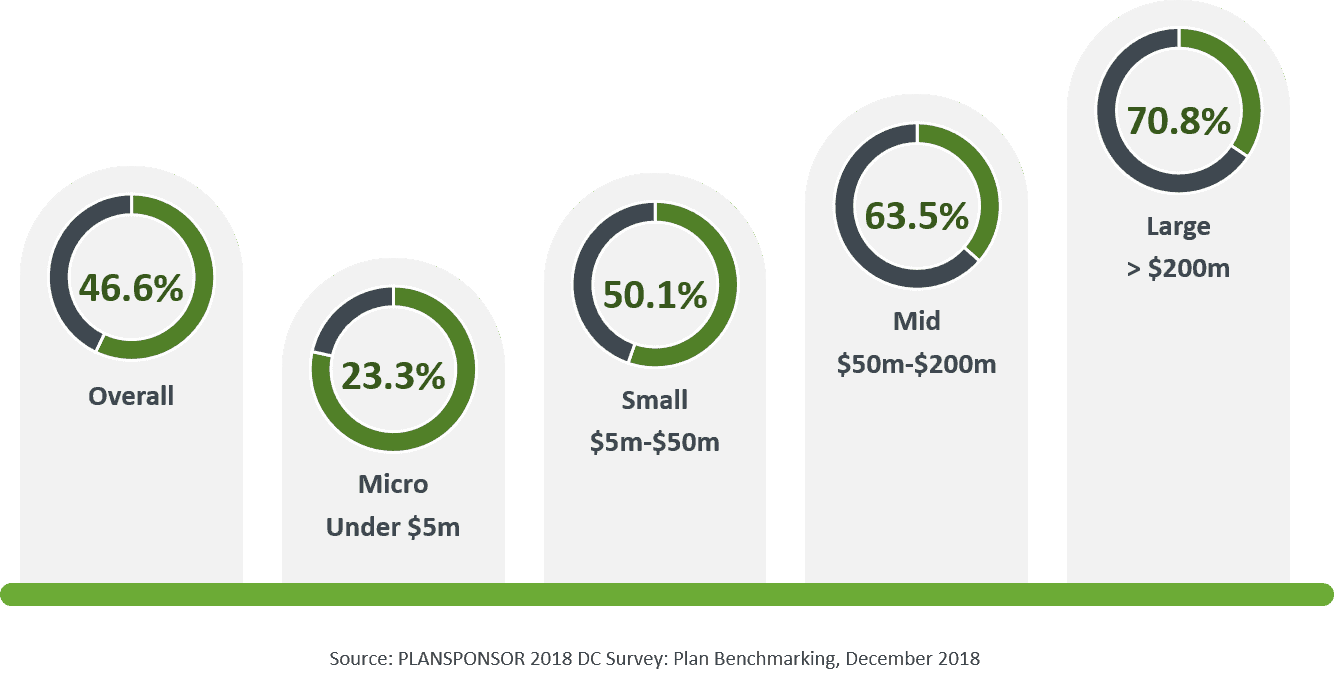

According to PLANSPONSOR Magazine’s 2018 defined contribution plan benchmark survey from December 2018, roughly 47% of all plans use automatic enrollment. Within the industry, the largest plans tend to be early adopters of research, trends and best practices and you can see this at work. Large plans tend to utilize automatic enrollment at a rate of around 3 to 1 over the smallest plans.

One of the biggest challenges to saving for retirement is actually having access to save. If someone is not participating in a plan they clearly can’t save. Automatic enrollment has been a huge success in driving increased plan participation.

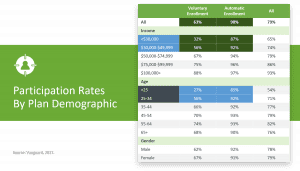

In 2015, Fidelity analyzed over 21,000 client plans and 13.5 million participants. They found that participation rates in voluntary plans averaged 52% while participation in automatic enrollment plans averaged 86% which is an increase of more than 30%.

One of the big concerns that many employers have, especially smaller ones, is that non-participating employees have made their choice clear, that they can’t afford to save or that employees will complain if automatically enrolled.

However, when you examine the evidence it’s clear that this isn’t the case. According to Vanguard, approximately 9 out of 10 participants do not opt out, even 3 to 3.5 years after being enrolled. Clearly, the behavioral inertia that keeps participants from joining the plan on their own helps them stay in the plan if forced to opt-out instead of opting in.

Similar to Fidelity, Vanguard analyzed participation rates within their client base in 2017 and found that participation rates were 63% for voluntary plans as compared to 91% for automatic enrollment plans. Further, the stickiness rates were substantially higher for lower-income and younger workers, who typically participate at much lower rates when required to join voluntarily. Workers earning less than $30,000 participated at a rate of only 32% when forced to voluntarily enroll whereas they participated at a rate of 87% when automatically enrolled.

And automatic enrollment dramatically helped younger employees. For instance,

eligible employees under age 25 participated at a rate of only 27% when forced to voluntarily enroll whereas they participated at a rate of 85% when automatically enrolled. Thinking back to the need to start early, the best possible thing you can do for the financial future of your younger workers is to automatically enroll them in your plan. Even still, the data suggest it’s never too late and that inertia isn’t simply an age thing. Workers over age 65 participated at a rate of only 68% when forced to voluntarily enroll whereas they participated at a rate of 90% when automatically enrolled.

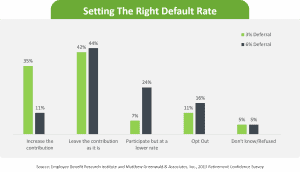

Once you’ve decided to implement automatic enrollment you have to choose a default percentage. The most common default percentage is currently 3% with approximately 50 to 60% of plans using this number. However, this trend is definitely changing and plan sponsors are getting more aggressive in their default percentages. At Greenspring Advisors, we are strong believers in setting the default at 6% because you are going to get your employees on track much further, much faster. We recommend a 6% default to our clients and we actually use this default for our own plan. When you look at the evidence, it’s clear that the level of the default rate has little to no bearing on opt-out rates.

For instance, in 2013 EBRI surveyed workers on what they would do based on a 3% default versus a 6% default. Here’s what they found. More than 40% of participants

responded they would leave the contribution as it is regardless of the default percentage. At a 6% default, an additional 11% said they would increase the contribution even further.

Somewhat surprisingly, at a 3% default, an additional 35% said they would increase the contribution even further. So essentially, nearly 80% of workers surveyed said they believed 3% was not enough. From an opt-out standpoint, setting the higher default had nearly no impact on opt-out rates, going from 11% at a 3% default to 16% at a 6% default. What this illustrates is that the people who are going to opt out are going to do so no matter what you set the default at.

Fidelity’s own research supports this idea as well. Approximately 20% of Fidelity clients set the default at 5% or higher and in those cases, 89% of participants stay enrolled. Given the evidence across the industry and in our own experience, your participants are going to follow your lead and a very high percentage will stick with the defaults you choose so it makes sense to be aggressive.

Participants ALWAYS have the choice to opt out, but the reality is that most won’t and if it really caused significant heartburn and frustration for employees you’d see much higher opt-out rates. If you’re serious about helping your people retire successfully you’ll do everything you can to put them on the right path as quickly as possible and that means an aggressive default percentage.

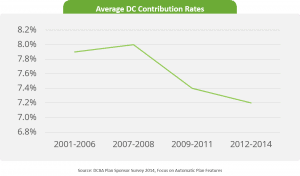

There is a possible negative side effect of automatic enrollment that we’ve seen in the industry. In fact, average deferral rates in defined contribution plans have actually slightly declined over the past 10-15 years. Automatic enrollment clearly drives much higher participation rates but it can actually lead to lower average deferral rates, especially when the default is set too low. That’s because people’s inertia gets in the way and they tend to get “stuck” meaning they will stay at or around the default rate unless there’s a mechanism to increase them.

As I highlighted from the EBRI data, more than 40% of people will stay at the default no matter what it is. If you add a lot of people to the plan at 3% and they stay there, it’s going to bring down the average deferral. In fact, those people who actually voluntarily join plans typically choose a contribution rate much higher than if they are defaulted.

To combat this trend of participants getting stuck at the default and to help them saving increasing amounts over time, it’s critically important to paid automatic escalation with automatic enrollment. Automatic escalation essentially increases a participant’s contribution rate, usually by 1-2%, each year unless they opt out. As a best practice, it’s typically best done in conjunction with raises and merit increases because participants won’t feel the impact.

According to PLANSPONSOR, automatic escalation is utilized at a significantly lower rate than automatic enrollment with roughly 38% of plans currently utilizing this feature. However, much like with automatic enrollment, the largest plans tend to utilize automatic enrollment at a rate of nearly 5 to 1 over the smallest plans.

Much like with automatic enrollment, opt-out rates with auto escalation tend to be very low. According to Fidelity, approximately 9 out of 10 participants do not opt out. Further, the evidence shows that greater unless participants are automatically escalated the vast majority simply won’t increase their savings rates. Fidelity cites that without auto escalation only 16% of participants increase their deferrals annually whereas 72% of participants increase annually when enrolled in an automatic escalation program.

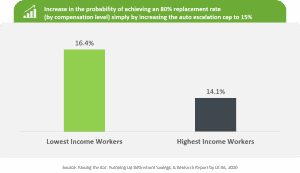

Another important consideration when implementing automatic escalation is where to set the cap. For instance, many plans may stop escalating at 6% or 8% or 10%. However, we believe in setting the cap much higher at 15%. A 2010 research report by the Defined Contribution Institutional Investment Association or DCIIA found that the simple decision to set the cap at 15% when using auto escalation increased the probability of achieving an 80% replacement rate by 16.4% for the lowest income workers and 14.1% for the highest income workers.

In Part 4 of this series, we will take a look at participant investing trends and keys to successfully implementing an automatic features program. If you want to find out how Greenspring Advisors can help supercharge your employees’ retirement savings habit, contact us to learn more.