In the investment world, much of the talk over the past few weeks seems to be revolving around the spike in interest rates and what that means for the global financial markets. While the move upward in rates has been swift, it is probably helpful to view this in context over the past few years.

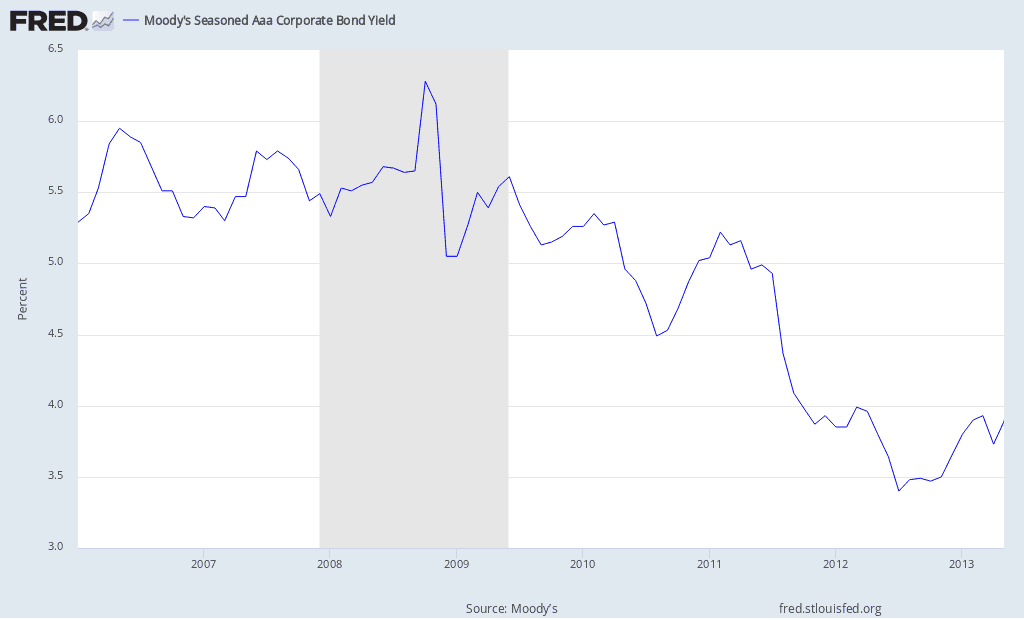

Moody’s Seasoned Aaa Corporate Bond Yield – Chart 2006-2013

The trend in bond yields has been consistently lower, with the last several months reversing that trend. As you can see, there have been multiple periods where yields have risen, only to reverse back to the trend of lower rates. The jury is still out on whether this latest rise in interest rates is a true reversal or just a speed bump during the long-term path downwards.

Why are interest rates so important?

Here are some of the reasons why interest rates are so important:

1. Interest rates dictate the consumer’s borrowing costs

Whether you are buying a home, a new car, or taking out a school loan, most large purchases are financed. The lower the interest rate, the smaller your monthly payment will be. Lower payments allow consumers to spend more on goods and services since less of their monthly income is tied to debt service.

2. Interest rates impact the government’s deficit

As rates rise, the government has to issue bonds at those higher rates. Debt service becomes a larger component of the deficit, causing the government to spend more of the budget on interest costs.

3. Interest rates impact capital flows

Higher interest rates will often attract foreign capital because of higher return prospects. We have seen this recently, with emerging market investments cooling off. Many investors seem to be concerned that capital will flow from those countries back to the US, as rising interest rates in the US offer a compelling alternative for their capital.

As you can see, interest rates have a tremendous impact on our overall economy; oftentimes in ways, we can’t even imagine. As borrowers, the last several years of declining rates have been a welcome sign, as we can finance our debts at lower costs. As savers, lower rates have created problems since we’ve had to take on more risk to get higher yields. We don’t know what direction interest rates are heading, but we know that they will be closely followed due to their importance on the overall economy and financial markets.