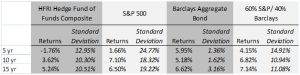

We are constantly reviewing the performance of various investment strategies. Over the past couple of decades, the rise of hedge funds has been spectacular, and I thought it would be helpful if we dug into their performance at a much deeper level. Here are some interesting statistics to review:

What you find is that hedge funds, when compared to other lower volatility strategies (bonds and diversified portfolios), have performed rather poorly. During periods where the equity markets have been lackluster (for example, the last 5 years), you would have expected them to shine. In fact, they have been one of the worst performers. In addition, the worst year hedge funds experienced was 2008, with a loss of 21.37%. This compares to a 5.24% gain in the Barclays Aggregate Bond Index and a 20.10% loss in 60% S&P 500 and 40% Barclays Aggregate Bond Index. Not exactly what you want out of a “hedge” when the markets are falling.

I will not pretend to know all the reasons why the underperformance has occurred, but I know a large factor is fees. The standard hedge fund charges 2% per year (on assets under management) with an additional fee of 20% of the profits. So is this trailing performance a reason to abandon the idea of hedge funds in your portfolio? Maybe or maybe not. We believe that consideration should still be given to this asset class for a number of reasons:

1. Fixed income cannot generate the steady 6% returns it has experienced in the past. It is mathematically impossible given that 10-year treasury bond yields are currently running at 2%. The idea that fixed income will generate inflation-beating returns in a low-risk asset class is no longer viable. We believe that certain types of hedged strategies could offer a compelling alternative.

2. As space continues to grow, there should be additional fee compression. To think that a hedge fund manager can make billions of dollars per year without competition is naive. At some point, other good managers will be willing to manage assets for lower fees (and still make tremendous income!)

3. More regulated products are coming on the market. Traditionally, hedge funds were run in large pools. Over the past several years, traditional investment vehicles like mutual funds and exchange-traded funds offer hedge fund strategies. This lowers the risk of rogue traders, excessive leverage, or other regulatory infractions.

What does Greenspring look for in an alternative hedged strategy?

1. A strategy that is not reliant on a manager’s skill. Fundamentally, we don’t believe that manager skill can last. Therefore, we’d rather choose strategies that actually work no matter who the manager is. Strategies like market-neutral funds make very little sense to us…the idea that someone can go long all the good stocks and short all the bad ones is highly manager dependent and not one we believe can stand the test of time. We focus on merger arbitrage and covered call writing which don’t require a manager to pick great stocks to perform well.

2. Transparent fees and holdings- to date, we are only using funds registered under the Investment Advisors Act of 1940. In short, there is additional regulation and requirements on them, reducing some of the leverage and oversight risk traditionally found in hedge funds.

3. Low fee structures- we don’t believe any managers are worth paying 2% of assets and 20% of profits. If they could guarantee outperformance in the future, that would be another matter, but we know they can’t. There are very few parts of the investment process we can control. Costs are one of them. We focus on low-cost funds as we know it will have a positive impact on performance over time.