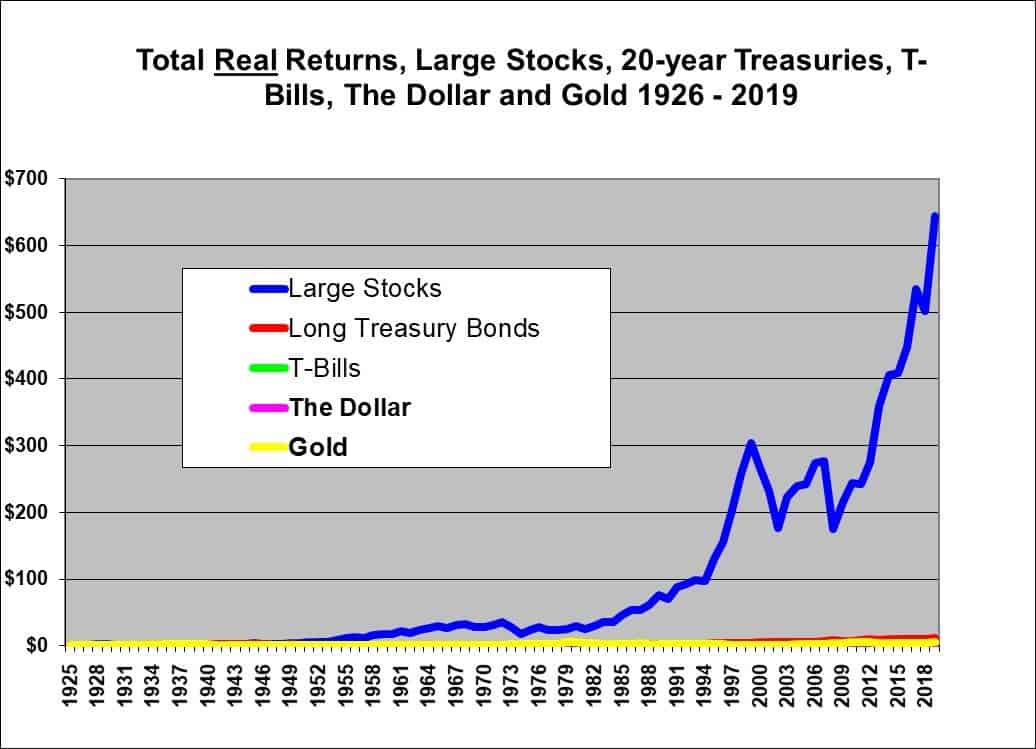

What is the best vehicle for accumulating long-term wealth? This is a question worth thinking about as an investor, and a recent Gallup poll shows that only 37% of those surveyed believed that stocks were a good method for accumulating wealth. This isn’t surprising. Over the past 13 years, we’ve lived through two stock market crashes of 50%+ with very little overall growth over that period. But let’s take a longer-term view of this. From the Investors Friend blog, we see this chart comparing the returns of stocks, bonds, gold, and the dollar. It is pretty clear who the winner is of these options:

So, are stocks the only game in town?

No, other investments to consider would be real estate and private businesses. Active ownership of a private business is probably one of the riskiest and most effective methods for accumulating wealth. If you go through the richest people on the planet, most acquired their wealth through this method. Realize that most private businesses fail, so for every successful entrepreneur out there, there are probably 20 or more that have either seen their business fail or have not generated significant wealth through this endeavor. Stocks are a better choice for most investors since they allow you to take a passive stake in a company versus some of the other options that require more active participation.

This chart is another example of why every investor should have some portion of their portfolio allocated to stocks. They allow you to participate in the profits of some of the best and well-managed companies in the world. Also, the long-term results speak for themselves.