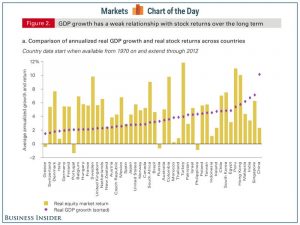

The economic data coming out these last few weeks have been spectacular. Whether it be employment, manufacturing, or consumer spending, the economy really seems to be on a roll. Before you buy some stocks as an early Christmas present, it is important to remember that the economy is not the stock market. We’ve talked about this before, and we’ve posted a great chart from The Business Insider (originally Vanguard data) that shows this to be the case:

You’ll see no real correlation between a country’s stock market return and GDP growth. Why is that? First of all, the market as a whole is pretty smart. Most situations where a country’s economy is going to slow down or expand are known well advance by market participants and are already priced into the market. Second, just because a country is doing well economically, it may not mean that the domiciled companies in that country are experiencing the same growth. If they are multinational companies, they may be experiencing growth or contraction in other areas of the world.

Just look at Thailand and Turkey on this chart. Over the past 42 years, they have experienced almost identical GDP growth, but Turkey’s stock market has grown at 12% per year while Thailand grows at less than 1%. Please remember this chart when you hear a pundit talking about how the market will perform because of some prediction he is making on the economy. They aren’t correlated directly, and it is dangerous to make investment decisions on such factors.