“My bond pays me 6%. It’s crazy that people own bonds yielding only 2%.” “My broker built a bond ladder of individual bonds. As long as I hold until maturity, it can’t lose value.”

You may have heard statements like this before. If true, it certainly appears that holding individual bonds (e.g., of a specific company like GE or Exxon) is superior to holding bonds via a mutual fund or ETF (which typically owns hundreds or thousands of bonds).

I frequently come across prospective clients that say the first quote above. When I look at their statements (typically from big brokers and not fee-only advisors), I see why. Their advisor purchased a bond for them recently, but it was originally issued by the company many years ago when interest rates were higher. Here’s the catch – bonds typically redeem at their par, or neutral, value of 100. But they will fluctuate over the years as interest rates go up and down or the company’s prospects appear better or worse. That 6% payment is merely the coupon rate that is paid out.

In this case, the gentleman paid 115 for that bond. The bad news is that when it redeems, he’s only going to get 100. He will lose 15%. Because of this confusion, the best interest rate to use is called Yield To Maturity (YTM). This number accounts for the value of the bond as well as the coupon payment. With this bond, the YTM was only 2%. That reflects the fact that the owner gets 6% each year but then loses 15% as the bond approaches maturity. It’s not quite the deal anymore when you look at it this way.

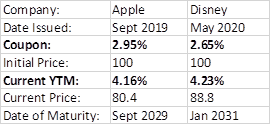

The second quote in my opening sentence is technically correct but not the full story. Here’s the catch – it ignores the fact that there can potentially be an opportunity cost to holding a bond with a lower coupon rate. Look at the two real-world examples below:

If you bought that Disney bond when it was issued in 2020, you will get back the full amount you paid. But you’ll also only get 2.65% interest along the way. If you bought that bond now, your YTM would be over 4%. So for the next 10 years, you lost over 1.5% of interest every single year. With a mutual fund/ETF, the yield adjusts every day to the true market value.

In addition, there are other advantages of a fund structure: a) diversification – a fund owns so many bonds that any single one won’t impact the returns very much (but if you owned an individual Lehman Brothers bond, you’d be happy with the yield until they went bankrupt); b) fees/costs – buying bonds, especially in small quantities, can be costly to individual investors due to the bid-ask spread.

For the vast majority of investors, the advantages of mutual funds or ETFs that we’ve listed above outweigh the advantages of owning individual bonds. If you want to understand more about how bonds fit into your portfolio, feel free to reach out to Greenspring for a complimentary portfolio review.

Would you like a schedule a call now?

You can get started now by booking an appointment with a financial advisor.

Information contained herein has been obtained from sources considered reliable, but its accuracy and completeness are not guaranteed. It is not intended as the primary basis for financial planning or investment decisions and should not be construed as advice meeting the particular investment needs of any investor. This material has been prepared for information purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance is no guarantee of future results.

Recent Insights