Every few years, investors seem to find some scheme to try to get rich. Most recently, it’s been Bitcoin. Over the past 20 years, similar behavior can be noticed with real estate flipping (2005-2007) and technology stocks (the late 1990s). In 1637 the same phenomenon could be observed with tulip bulbs in Holland. At the peak, some tulip bulbs were trading for ten times an average worker’s annual pay!

I have been fortunate enough to live through and counsel clients through many of these booms and busts. After advising hundreds of wealthy individuals and families over the past two decades, I have found one ratio that has been key to allow them to accumulate AND preserve wealth. Those that focus on this ratio can overcome many obstacles the financial markets throw at them (like the booms and busts we have been accustomed to). This ratio has worked for business owners, corporate executives, blue-collar workers, and anyone else trying to save for the future. By focusing on this key metric, many other areas of your finances will work themselves out. What is this magic ratio?

Your savings rate.

You calculate this simple metric by dividing the amount you save by your gross income. So if you save $25,000 and you earn $200,000, your savings rate would be 12.5% ($25,000/$200,000). Most of these numbers should be fairly easy to ascertain. For income, go to your tax return and use your gross income on the first page. For savings, add up all the deposits that went into investment or savings accounts (401k plans, IRAs, brokerage accounts, etc.). Why is this such an important number?

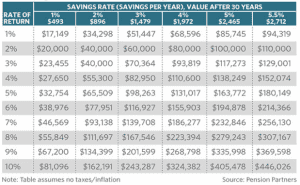

First, how much you save obviously directly correlates with how much you have available in your nest egg at retirement. Many people spend too much time on their investment returns, and while they are important, savings rates are much more impactful. This chart shows how a low savings rate coupled with a high return is outpaced by a higher savings rate with a low return.

Second, when you have a healthy savings rate, you are crowding out other areas of your budget that would cause you to need even more money at retirement. For example, by maintaining a high savings rate, you would not be able to take out substantial amounts of debt or spend extravagantly on current expenses. In this way, you are attacking the problem of funding retirement from two sides- increasing your savings rate allows you to accumulate more. Still, it also curbs your spending so that you don’t need as much capital to fund your lifestyle in retirement.

One of the most common questions we hear is how much investors should be saving. This is a highly personal question that really needs to be answered by everyone individually. If you have a financial advisor, this is a key question that he/she should be answering for you. If you don’t have an advisor, I’d recommend using an online calculator like the one found here. It is not ideal, but it is better than having no plan at all. Finally, once you settle on how much you should be saving, you have to automate it. Defer a portion of your income into your 401k each pay period, set up a direct deposit into an investment account each month. Anything that doesn’t require you to think about having to do it.

Focusing on your savings rate is simple, but it’s not easy. For those that can maintain this key metric, they will find retirement an attainable goal.