One of the most important things a company can do to equip its retirement plan committee members properly is to provide comprehensive fiduciary training. It’s an important step to minimize fiduciary risk through education and governance. Furthermore, the DOL views fiduciary training as a critical element of prudent oversight and is increasingly looking for evidence that fiduciary training has been provided during plan audits.

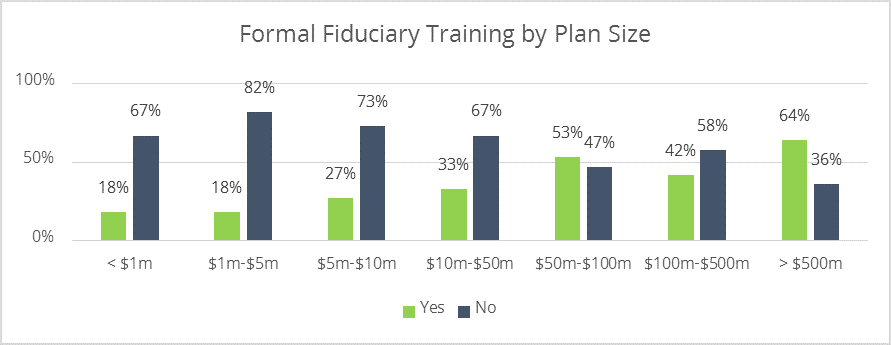

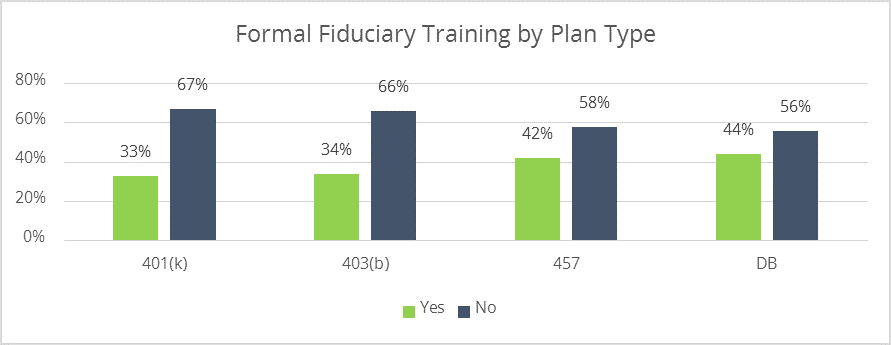

Unfortunately, formal fiduciary training is still not very common within the industry. In 2017, Xponential Growth Solutions surveyed 977 plan sponsors and found that nearly 70% had not received any formal fiduciary training. A breakdown of the responses, both by plan type and size, are highlighted below:

What topics should be covered in fiduciary training?

Listed below, you will find the 10 areas we think to form the foundation of a comprehensive fiduciary training curriculum:

- Overview of ERISA – Covers the history and background of ERISA and which plans are subject to the regulation.

- Fiduciary Status & Duties – Reviews fiduciary vs. non-fiduciary functions as well as ERISA’s fiduciary duties and elements of a prudent process.

- Fiduciary Liability – Discusses common fiduciary breach claims, consequences of a breach, and prohibited transactions.

- Plan Management – Addresses various aspects of the plan document, amendments, Form 5500, and participant disclosures.

- Plan Investments – Describes investment duties under ERISA, selection and monitoring best practices, and 404(c) protection.

- Plan Fees – Covers fee types, allocation methods, revenue sharing, and administrative vs. settlor expenses.

- Vendor Selection & Management – Reviews how to properly evaluate and select vendors and service providers and outsourced 3(16) administrative services.

- Hot Topics for Fiduciaries – Discusses fee litigation, DOL and IRS enforcement priorities, target-date fund (TDF) selection, and the DOL Conflict of Interest Rule.

- Litigation Lessons – Describes several landmark court decisions that provide “real-life” lessons about the importance of a prudent fiduciary process.

- Other Issues & Best Practices – Addresses bonding and insurance, fiduciary governance/oversight structure, and the importance of fiduciary process documentation.

At Greenspring Advisors, we believe so strongly in properly training retirement plan committee members that we developed an online ERISA fiduciary training course in consultation with two of the country’s leading ERISA attorneys, Fred Reish from Drinker Biddle and Adam Meehan from Smith & Downey, P.A., called Fiduciary (k)larity™ . This program was specifically designed for retirement plan committee members seeking to minimize risk and educate their teams. The program is a cost-effective and valuable investment for any company, especially compared to the potential cost of a settlement agreement with the DOL or an ERISA lawsuit. If interested in this program, click here to learn more or contact a team member on our Retirement Plan Team by calling Greenspring today.