One of the big themes we have seen over the past several years is capital over labor. Corporations have seen an explosion in income while paying their workers some of the lowest wages in history.

Corporate Profits vs Wages Chart

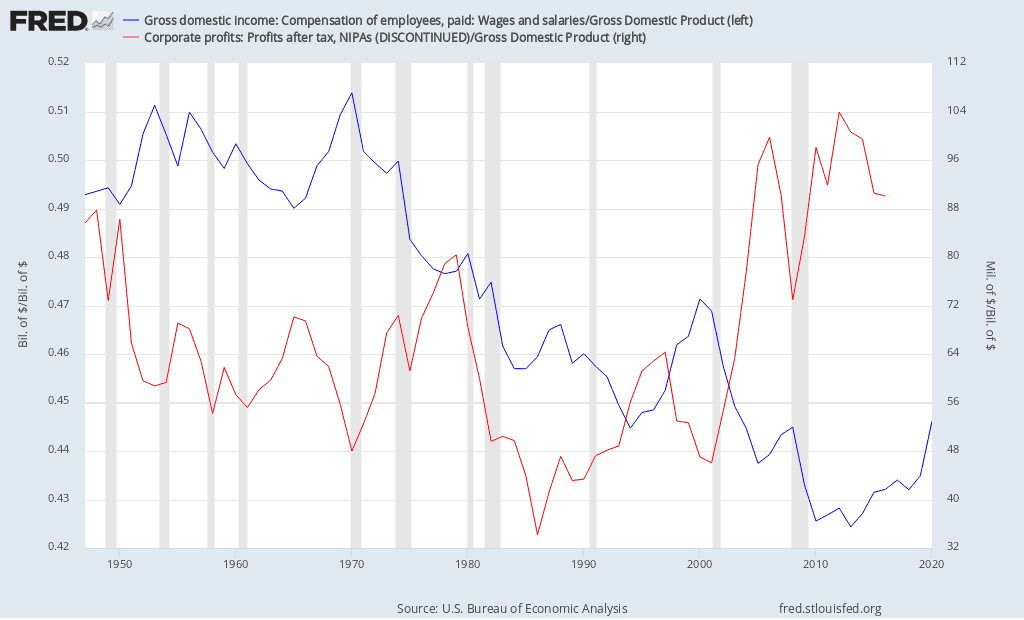

Here is a chart that shows labor as a percentage of GDP (blue) versus corporate profits as a percentage of GDP (red):

Corporate Profits vs Wages Chart

Some commentators have been arguing that companies should be paying their workers more. How can they be earning record profits while not sharing any of those gains with the workers who have helped them create them? Others say that these trends will fluctuate over time and that the free market should dictate who gets paid what share. We are less concerned about the rhetoric and ideology and more concerned about investment implications.

Could stocks get revalued at much lower prices?

One concern amongst investors is that corporations are making more profit for each dollar of sale than they ever have. If that profit margin comes back to historical averages, we could see stocks get revalued at much lower prices. This is a very valid concern, but you first have to think about why profit margins would revert to their mean (which they normally do). As you look at the chart above, you’ll see an inverse relationship between these two variables. If companies finally start paying their workers more (or hiring more), we could certainly see profit margins shrink. Still, if there are more people earning income because of higher-paying jobs, there is the potential for companies to generate more revenue. Earning a smaller share of a larger pie could still be a winning proposition.

Countless other variables have to be factored into this analysis. Still, we will continue to watch these two data points to understand how wealth is being distributed between individuals and corporations.