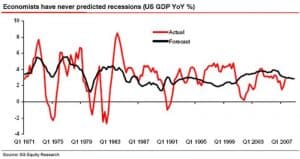

One of our favorite pastimes as an industry is forecasting the future. Whether it be stock prices, the economy, or the direction of interest rates, every year, economists put out their projections, while the rest of us wait in anticipation. As we’ve argued before on this blog, market forecasts are essentially useless and cause more harm than good. We thought this chart from Societe Generale captured our thoughts nicely.

Economic forecasts are almost always in a tight range, while actual growth in the economy tends to have massive swings up and down. Economists tend to either massively under or over-shoot the actual results. Next time you find yourself listening to an economic prediction for anything other than pure amusement, please come back and review this chart.