The events of the past several weeks have been devastating and unsettling on many fronts. The loss of life and the humanitarian disaster caused by Russia’s invasion of Ukraine is hard to put into words. When it comes to how these events have impacted the investment markets, there are several items we believe investors should keep in mind:

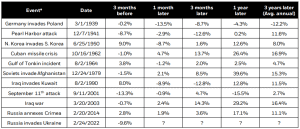

1.“This time it’s different.”– This simple thought (that almost everyone has) can be a trap when investors base buying and selling decisions on events they believe are unprecedented. Investors would be well-served to remember the saying, “History may not repeat, but it often rhymes.” With this perspective, it is helpful for us to understand how the market tends to react to major geopolitical events:

Another important reminder is how normal drawdowns in the market actually are. On average, the market has experienced a 14% intra-year drop each year since 1950. We are currently down about 12% from peak to trough. Unfortunately, these losses are a feature, not a bug, of investing in stocks.

Finally, there are two things that September 11th, Coronavirus, World War II, and every other unforeseen tragic event have in common. First, they caused short-term investment losses. Second, the only investors that lost money were the ones who sold during these events.

2. Diversification matters– In most Greenspring portfolios, Russia represents less than 1% of our total equity holdings. So, while Russia’s stock market is down over 70% through March 7th, the overall impact on client portfolios has been minimal. Unfortunately, markets around the world have also been impacted by these events. The US is no different. For the last 10+ years, the best investment for most investors has been large US companies, especially those focused on growth. We have been steadfast in our position during this period that there will come a time when those stocks become out of favor. That time has come. The top 5 largest stocks in the S&P 500 (making up around 25% of the total value of the index) had the following returns through 3/7:

Apple: -8%

Google: -9%

Amazon: -13%

Microsoft: -14%

Facebook: -41%

Having a diversified mix of assets in your portfolio has helped weather the storm. Bonds and alternative assets have served as a ballast to the portfolio and tempered losses during this difficult time.

3. Markets are efficient– this means that stock prices tend to reflect all the information that is known today. So, if you think that conditions could get worse in Ukraine, and that is the consensus, most likely that is already priced into stocks. Selling now would be betting that things are going to get even worse than people believe which is almost impossible to know. Don’t believe us? Try this little thought experiment. Let’s say today Russia announces that it is pulling out of Ukraine and will go back to the policies it had prior to the invasion. What do you think the markets would do? If you said, “go up”, you are most likely right and you also are admitting that prices today are reflecting all the problems this is causing in the investment markets. Depressed prices reflect investors’ expectations for the future. The best strategy is often accepting those prices and not trying to outguess the market. Those that have tried have not fared well.

This isn’t the first and won’t be the last time we have a major global event shock the markets. If this event mirrors other historical shocks, the market will bottom when things seem hopeless and the future looks bleak. Warren Buffet said it best, “If you wait for the robins, spring will be over.” For those who have been sitting on cash to invest, now is a great time to develop a plan to get that cash deployed. Things may look bleak, but we don’t believe Russia invading Ukraine is going to stop our human race from innovating, developing new technology, creating new products, and starting new businesses. In fact, over half of the Fortune 500 companies started during a recession or bear market. That is why we remain optimistic about the future.

Finally, at Greenspring the steps we are taking to help our clients include a) meeting frequently with our Greenspring Investment Committee to monitor the situation and adjust as necessary, b) rebalance when appropriate – buying low and selling high, c) taking advantage of tax-loss opportunities where available, d) remaining disciplined, diversified, and focused on the bigger picture to ensure our clients meet their financial goals. CONTACT US

Sources: BlackRock; Morningstar as of 2/28/22. *Returns shown for events prior to 1979 are represented by the S&P 500 PR Index, which shows principal returns only (excluding dividends), from 1/1/26 to 12/31/78. Returns for these periods would likely be higher if dividends were included. Returns for events in 1979 or later are represented by the S&P 500 TR Index, which shows total return (including dividends), from 1/1/79 to 2/28/22. Index performance is for illustrative purposes only. It is not possible to invest directly in an index. Past performance does not guarantee or indicate future results.