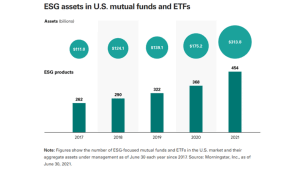

As our attention spans grow shorter and we continue to abbreviate words to save time and energy by typing fewer letters (LOL) the investment world (BTW) has been using one acronym, ESG, for over 30 years. What may sound like a spoonful of alphabet soup is actually a term used to describe investments oriented towards Environmental, Social, and Governance factors. If you have been hearing the term “ESG” more and more, It should not come as a surprise as ESG has seen a surge in popularity. According to Refinitiv Lipper, in 2021 a record $649B flowed into ESG funds and ESG funds now comprise 10% of worldwide fund assets. Although the majority (60%) of those funds are held outside the US, interest in ESG in the US is steadily growing. The chart below illustrates the growth of ESG assets in US mutual funds and ETFs (an ETF is a basket of stocks that trades on an exchange).

What Does ESG Mean?

ESG is a broad term that encapsulates criteria and priorities investors can apply to evaluate companies; it can mean a lot of different things to different people. Continuing with our alphabet soup analogy think of ESG as a big bowl of values-based investing. Within that bowl of alphabet soup, you could select an “E” (Environmental), an “S” (Social), or a “G” (Governance). The letters that you scoop onto your spoon are non-financial factors that you can apply to evaluating companies. There are numerous ESG factors but let’s look at a sampling of criteria. The “E” may include carbon emissions, pollution, biodiversity, deforestation, water scarcity; “S” may include labor standards, human rights, gender and diversity, employee engagement; and “G” may include board composition, corruption, executive compensation, lobbying.

ESG investing has been around for decades but has become a louder part of the investment conversation over the last few years. Let’s go back in the kitchen and add some more letters to the soup, S, R, and I. “S” (Socially), “R” (Responsible), “I” (Investing) is the precursor to ESG and was the practice of excluding stocks from the portfolio such as tobacco stocks or companies that did business with South Africa during the Apartheid regime. As values-based investing evolved, ESG factors and ratings became an accepted means to evaluate companies in addition to just using financial metrics. Sustainable is another word used interchangeably with ESG and SRI. While “sustainable” has come to be associated most recently with “green” or climate factors, historically it has been considered more broadly as an approach focusing on entities that help make the world a better place. Let’s get back to our alphabet soup. We start with the bowl (values-based investing), add the broth (sustainable investing), and sprinkle in some “E”, “S”, and “G” so we can differentiate between alphabet soup and say, chicken noodle or minestrone.

ESG Growth Factors

Multiple and disparate factors are contributing to the growth of ESG. A changing world presents global challenges that must be addressed, a new generation of investors is directing dollars to areas that align with their values, and better data and technology enables better analysis and validation of data. There is no indication that any of these primary factors are waning. What was once the purview of socially conscious investors and institutions is now accessible to the mainstream investor and is here to stay.

Greenspring provides ESG options for clients aligned with our overall investment strategy of focusing on a low-cost, globally diversified portfolio. If you have an interest in learning more about ESG investing, we encourage you to contact us today.

ESG Blog Series Part Two: ESG- Does It Really Make A Difference?