On the day of what has been billed as the most important election of our generation, we wanted to revisit a very important question for investors: Should elections influence long-term investment decisions? To answer that question, it makes sense to dive into some of the data to lend us some perspective.

- Investors invest in companies, not a political party– when you invest in a company, you are buying a share of its future earnings. Companies are focused on serving their customers and growing their businesses, regardless of who is in the White House. Because of that simple truth, the natural state of the world economy is progress, no matter who is in office. As a consumer of many of the companies you might own, just because your party doesn’t win the election, will you stop buying groceries, paying your electric bill, buying the latest iPhone, or purchasing a new car when you need one? The answer is probably no, which means that companies don’t need a specific candidate to succeed.

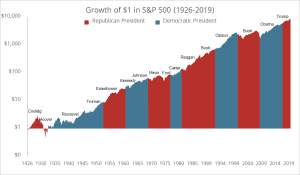

- Be careful of mixing politics and investing– many candidates like to campaign around how they would positively impact or how their opponent would negatively impact the economy. While US presidents may impact market returns, so do hundreds, if not thousands, of other factors. When we look at the data, we find that market returns have been positive no matter which party is in office[1]

- Markets are efficient– the price of a stock tends to reflect all the information known about that company at any given point. No matter where the polls are leaning, a company’s prospects and overall trends worldwide tend to get priced into stocks immediately, making it extremely difficult to beat the market consistently. Rather than trying to fight this inevitability, we have embraced it, focusing instead on making sure we are broadly diversified, keeping fees as low as possible, and, when possible, rebalancing the portfolio (i.e., buying when investments are low and selling when they are high).

- What Greenspring is keeping an eye on– if President Trump retains the presidency and/or Republicans retain the Senate, we expect little in the way of tax reform. But, in the event of a Democratic sweep, there is a real possibility we could see some significant changes to tax laws. These changes could potentially happen next year, so we are keeping a close eye on the presidential election and the House and Senate elections. With potentially higher income, capital gain, and estate tax rates in the future, many of our clients will need to consider planning strategies to minimize future tax liabilities. We have already started reviewing year-end tax planning strategies, and the results of the election may throw another wrinkle into how we are planning for taxes both in 2020 and beyond. There will almost surely be more to come on this topic, and Greenspring will be ready to meet your personal needs.

It is entirely natural to be nervous about the unknown, but politics can be hazardous to your wealth, as we’ve stated before. As we consider the data in the chart above, we find it comforting, albeit fascinating, that markets have grown no matter who is in office, but also in the face of some terrible crises – World Wars, depressions, out of control inflation, terrorist attacks, and political turmoil have all been a part of our past. As investors, we have lived through bouts of volatility even when it may have felt terribly uncomfortable at the time. Despite these difficulties, the market continues to reward investors who are patient and disciplined.

If you have any questions or concerns, please reach out to your advisor.

[1] Past performance is not a guarantee of future results. Indices are not available for direct investment. Therefore, the performance does not reflect the expects associated with the management of an actual portfolio.