Many of our clients still in their working years do not qualify to make Roth IRA contributions (2020 income limits are $139,000 for single filers and $206,000 for married couples). But from time to time, clients do qualify to contribute, and we often recommend doing so (maximum contribution for 2020 is $6000 and $7000 if you are over 50). We’ve done some work to quantify the value of making a Roth IRA contribution versus just leaving those funds in your taxable investment account. To review the logistics of how Roth IRA accounts work, contributions grow tax-free for your lifetime (and your heirs, if they inherit it). Another added benefit is there are no required minimum distributions that need to be withdrawn at age 72 like a Traditional IRA.

What is the real benefit of a Roth IRA in dollar terms?

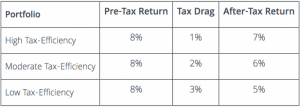

Larger after-tax returns are where you get the biggest bang for your buck. Every year, you have to pay taxes on dividends, interest, and capital gains in a regular brokerage account, effectively lowering your after-tax return. Some studies have pegged this “tax drag” on returns at well over 2% per year.

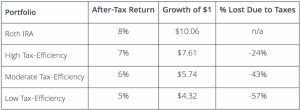

In our study, we looked at 3 different taxable portfolios of varying tax efficiency, all earning 8% per year PRETAX, to compare them to a Roth IRA:

Our study is assumed to take over 30 years, with the contribution made in the first year. The results show how powerful Roth IRA contributions can be if allowed.

Roth IRA accounts can be precious vehicles for those that qualify when compared against investing in a taxable brokerage account. While there are limits on how much you can contribute, you can significantly increase your portfolio’s after-tax return and your overall after-tax wealth by making those contributions in the years when you are allowed.

*Always be sure to consult your tax and financial advisor before making any tax and investment decisions.