It seems like we cannot go a day without hearing questions about a recession. Will we enter a recession, how long will it last, and how bad will it be? No one truly knows the answer to any of those questions, but we have taken a look at one of the favorite data points economists tend to look at in order to identify upcoming recessions, the Philadelphia Fed Business Outlook Index, and evaluated whether it has any predictive ability on stock returns.

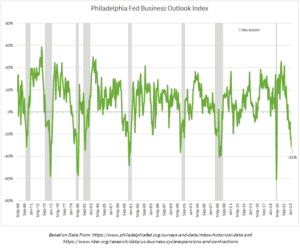

The Philadelphia Fed’s survey-based Business Outlook Index is below 0, suggesting that some manufacturers have a very pessimistic expectation for the economy. The recent April data point marked the lowest level the index has reached since the beginning of the COVID-19 pandemic and displays similar levels from what was seen during the Global Financial Crisis in 2008. As you can see from the below graph, large negative spikes in this index have closely aligned with economic recessions. With all the negative headlines related to financial markets, it’s understandable why many investors have become worried about their portfolios during these volatile times. As always is the case, it is pivotal for investors to stay the course and stick to their investment plan during these times.

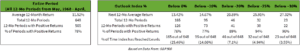

Since the index began in May of 1968, it has shown a negative outlook 165 out of 648 times – in other words, 25% of the time it has been negative! For those 165 occurrences where the outlook was negative, the following 12-month return of the S&P 500 index was positive 76% of the time, with an average return of 13.42%. To put that in perspective, over the entire history of the index, the frequency of positive S&P 500 returns over any 12-month period was 78%, with an overall average 12-month return of 11.52%.

Building upon this further, as the outlook becomes increasingly negative, not only does the likelihood of experiencing a positive return in the following 12-months increase, but it historically has also increased the magnitude of positive returns. For example, when the index drops below -30% like it was as of April 30th, 2023, the average 12-month return is over 27%! This shows that while the Fed Business Outlook Index may show the correlation between manufacturers having a pessimistic outlook on the economy and impending potential economic recessions, it is not indicative of what future stock market returns will look like.

While different economic data points and outlook surveys can be useful tools to understand the current business and economic environment we are in, they are not necessarily good indicators of what the future stock market environment will look like. Although this is just one data set, it helps to show that markets actively price in changes in economic states before they come to fruition. You should not base your investment decisions on factors like these since they are not reliable indicators of future stock market activity. When eerie news headlines about the economy dominate the market, that is not the time to sell out of your stock positions or change your investment approach – it is the time to stick to your investment plan, let your diversification weather the storm, and reap the potential benefits that could be on the horizon.

As always, we are here to help. If you have any questions or concerns, don’t hesitate to contact us!

Information contained herein has been obtained from sources considered reliable, but its accuracy and completeness are not guaranteed. It is not intended as the primary basis for financial planning or investment decisions and should not be construed as advice meeting the particular investment needs of any investor. This material has been prepared for information purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance is no guarantee of future results.

Recent Insights

Fleeting Fad or Future Fortune – The New Bitcoin ETFs are Here

Tax Drag: Picking Up Nickles