With much attention on the Federal Reserve and interest rates recently, we want to dive deeper into what it means when the Fed cuts rates, how it affects the broader economy, and what potential investment implications you should consider.

What Has Happened So Far, and How Does This Impact You?

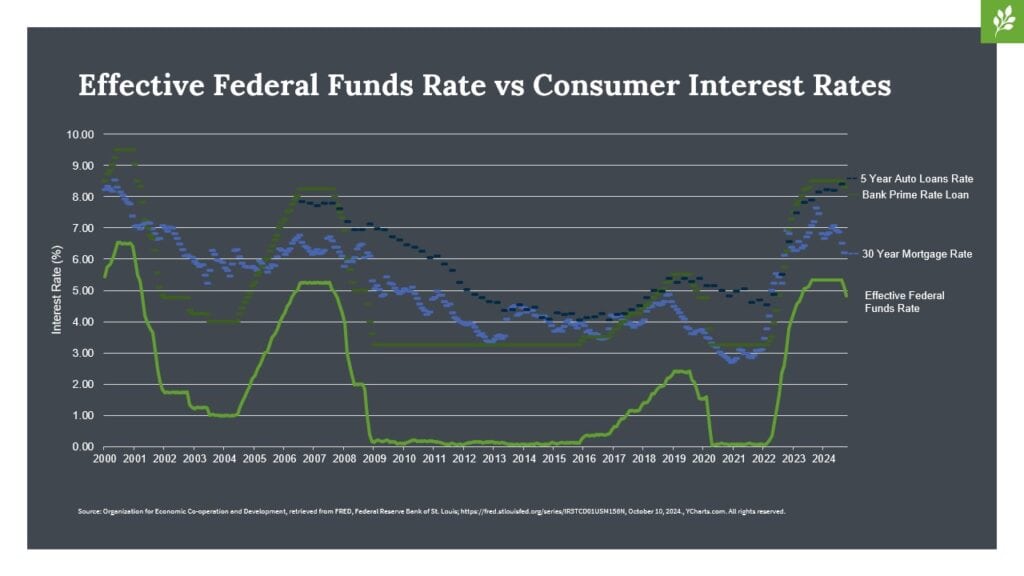

After one of the most aggressive rate-hiking cycles in history, the Federal Reserve finally made its first rate cut in September, lowering the federal funds target rate by 50 basis points, or half a percent. This move comes after months of speculation about when the Fed might begin easing its rate policy.

When the Fed cuts rates, they lower the rate banks charge each other for overnight lending, but the effects ripple far beyond the banking system. This shift in policy directly influences key areas of consumer finance, including credit card interest rates, student loans, home equity lines of credit, small business loans, auto loans, and mortgage rates.

As the Fed lowers rates, many aspects of the economy may experience relief. Lower interest rates often lead to lower payments on various types of loans, potentially easing financial pressure on households and businesses. If you’ve taken out loans or mortgages within the last couple of years, there may be opportunities to consider refinancing in the near future if rates continue trending downward.

Actively working to reduce your debt payments can improve your overall cash flow available for saving, so it is important to continuously evaluate your situation as the interest rate environment changes over time.

The Investment Implications

Over the past few years, many investors have capitalized on higher interest rates by holding excess cash in high-yield savings accounts, money market funds, and certificates of deposit (CDs). These vehicles have provided attractive and low-risk returns, with yields much higher than these investments would have earned in recent years. However, the Fed cutting rates means these yields will also trend downward, reducing the benefit and return on investment that these assets provide with each corresponding Fed rate cut.

So, What Can You Do To Help Navigate This?

As yields on cash-like investments decrease, we believe transitioning a portion of your cash holdings into a well-diversified, investment-grade bond portfolio could be a sensible move. Here’s why:

- Strong Yields on Bonds: Just as these cash-equivalent investments were able to earn higher yields when the Fed raised rates, bond yields benefited, too, and have higher yields now than before the Fed began hiking rates in 2022. Investors can earn meaningful income in the bond market, as the average yield to maturity for investment-grade bonds is at 4.66%1 (as of October 23, 2024).

- Potential for Capital Appreciation: Bonds have an added advantage over cash-like investments. When interest rates fall, bond prices typically rise, providing a boost to bond fund returns2. This contrasts with money market funds, high-yield savings accounts, and CDs, which only offer lower yields as rates decline without any potential price appreciation.

By moving excess cash into a bond portfolio, you may be able to continue capturing higher yields and, if rates do fall over time, earn additional return through capital appreciation.

In Summary

The Fed began cutting rates in September, and current data suggests more cuts may follow in the coming months or years. While the path forward is uncertain, we believe that falling interest rates will lead to reduced yields on short-term, cash-like investments for those holding significant amounts of cash in these vehicles.

Moving that cash into a well-diversified bond portfolio could be an effective way to mitigate the risk of lower yields, adding value to your investment portfolio and hopefully better positioning you to achieve your financial goals.

Thank you for reading, and as always, feel free to reach out with any questions.

Footnotes:

1 Represents the average yield to maturity for iShares Core U.S. Aggregate Bond ETF, a proxy for the investment grade bond market, as of 10/10/2024

2 For illustrative purposes only. Assumes a bond paying 4% with a fixed semiannual coupon and a 10-year maturity