Many major asset classes have experienced substantial growth over the last several years, resulting in very expensive valuations. This has led some investors to think beyond traditional investments like stocks and bonds and consider investing in single-family residential real estate for its steady cash flow and price appreciation potential. An analysis by Redfin showed that investors accounted for 18% of all home sales in the third quarter of 2021 (a record high).

Using the data for support, we ask ourselves, can this be a good use of capital for investors looking to earn higher potential returns? Here are a few reasons why investors should remain hesitant about investing in real estate at this time:

Price Matters.

With real estate prices surging in many parts of the country, investors should be wary of buying properties that have skyrocketed over the past year. According to CoreLogic HPI, the average home price increased year-over-year by 20% in February 2022. Buying at good relative valuations is the hallmark of almost all good investments.

Rents Matter.

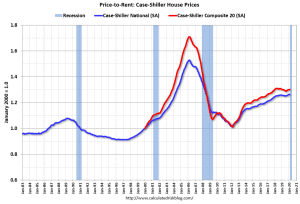

You may be saying to yourself, “Who cares what I pay if the rent I am receiving is going up commensurately with prices?”. And in many ways, you would be right. Increasing rents can offset higher prices by generating more income for the property owner. But rents have not been going up in lockstep with home prices. In looking at the Price-to-Rent Ratio, we find that the national averages have hit all-time highs (since it was initially measured in the early 1980s). That means that rents are the smallest share of home prices on record. Not a good recipe for an investor who is counting on income to generate a return on their investment.

Rates Matter.

Assuming you will finance your rental property purchases, mortgage rates are a key component in determining your return on investment – the higher your interest costs, the lower your return. While mortgage rates are still relatively low, the 30-year mortgage is now up to 4.72% as of April 7, 2022. That’s up from around 3% just a year ago.

When you put all these together, you have higher prices, rents not keeping pace, and higher borrowing costs. These are all things that are working against an investor thinking about getting into this asset class. We have a few suggestions to consider if you already own rental real estate or are considering buying it:

- Know your numbers. Whether you own a property or are thinking of buying, make sure you run your numbers. You should know what your cash-on-cash return is projected to be, what the cap rate is on your investment, and what you project your internal rate of return (IRR) to be. If these numbers don’t compensate you adequately for the risk you are taking, don’t be afraid to walk away. If you already own a property and your numbers tell you to expect a low future return (most likely because of the huge gains you have seen these last few years), maybe it is a time to think about selling.

- Real estate is local. We are quoting national figures when reviewing fundamentals. The reality is the market in Baltimore, Maryland is completely different than the market in Austin, Texas. Everyone should do their own homework since every region and area differs considerably.

- Rental real estate is NOT passive income. Anyone who has owned real estate knows this. Between collecting rent, finding tenants, dealing with repairs, handling the finances, and recordkeeping, you need to make sure you understand all that goes into owning rental properties. If deciding to delegate these responsibilities to a 3rd party, consider the impact on your investment return.

- Be careful of banking on appreciation. We would caution any investor counting on high price appreciation to generate a decent return. There are countless examples (most recently 2008) where that has been devastating to investors. Investors who are solely focused on appreciation run the risk of having negative cash flow coupled with potential price depreciation when the inevitable downturn comes.

Purchasing an investment property can be a complex process. We have helped many clients analyze these investments and are happy to assist if you are considering purchasing a rental property or would like an evaluation of an existing portfolio of properties. Please feel free to reach out to me set up time to discuss your options.