Goliath. Achilles. The bear from The Revenant. Powerful, imposing, and victorious as these legendary figures became, their mighty falls remain infamous…

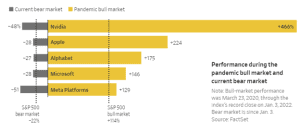

The FAANG stocks that saw extraordinary performance in recent years are plummeting to valuations not seen since the early 2000s, and it is likely to get worse. The tech giants’ rout have deepened to -43.64% YTD, while the S&P 500 has dropped -21.26%, dragging the broader market into its first bear market since early 2020.

Investors feeling a pressure reminiscent of the dot-com bust have yanked a record $7.6 billion from tech-focused funds, according to Morningstar Direct data. This monumental selloff has erased trillions of dollars of market value in a few short months. Soaring inflation that erodes purchasing power, rising interest rates, and the threat of a recession that could gouge company profits is pummeling growth and tech stocks hardest.

Investors are asking – how did this happen?

According to a May article from the Wall Street Journal, eight companies carry the blame for about half the stock market’s decline this year. Heading into 2022, Apple Inc., Microsoft Corp., Amazon.com Inc., Tesla Inc. and the parent companies of Google and Facebook formed 25% of the S&P 500. Weighted by market value, the benchmark U.S. stock index gives the most influence to the biggest companies.

These stock market darlings, along with Netflix Inc. and Nvidia Corp., that propelled the market to new heights over the last decade have quickly fallen out of favor, marking a dramatic shift in investor sentiment. From 2012 to 2021, the FAANGs returned 28.02% per year, dominating the performance of the Russell 3000 Index – returning a modest 16.3% per year during the same period. Their success far exceeded most investors’ expectations which may have set an unrealistic precedent for this century’s Roaring ‘20s. What were once reliable and massive market winners are suddenly the culprits of widespread carnage. And yet, this is not surprising, and history suggests the reign would not last forever.

The impact of inflation.

The first crack in the dam appeared late last year when it became clear that inflation was not easing. In fact, the annual inflation rate in the US grew to 41-year high of 8.5% in March of this year. For perspective, the average rate of inflation in the US was 3.26% from 1914 – 2022. A few key factors pushed inflation higher.

- The Federal Reserve infused a surplus of money into the economy because of the COVID-19 pandemic. Banks were able to issue more loans, which increased the overall supply of money.

- Global supply chains experienced major delays, effectively increasing the cost of production, including raw materials and wages. Demand for production surged, yet consumers were willing to pay more.

- The Federal Reserve initiated a rate-hike cycle to counter rising inflation. Tightening the monetary supply forces interest rates higher, making borrowing more costly. Inevitably, economic growth slows because the cost of everything from gas to clothes to plane tickets to baby formula become nearly prohibitive, and people stop spending.

An economic slowdown does not favor big tech stocks.

Inflation may take too long to cool, causing the Fed to lift rates even higher, further punishing the market’s weightiest stocks. This is where the tables turn for value stocks to earn their keep. A story similar to that of the tortoise and the hare.

For years, investors preferred the expensive, often overvalued but fast-growing tech companies. Cheaper, slower-growing companies with strong books were overlooked. COVID-19 shifted the way consumers lived, shopped, and worked from home, further swelling their risky bets in – and powering the growth of – cryptocurrencies, SPACs, and many other tech companies. And they were paying off.

While the S&P 500 surged 90% in the three years the ended in 2021, the FAANG stocks were among the largest contributors to that market growth. Apple, for example, rose 81% in 2020. But this year, the revered FAANGs are experiencing their sharpest falls. Collectively, they have all suffered double-digit percentage drops this year, most of them far steeper than the S&P 500’s. So far this year, only the energy and utilities sectors of the S&P 500 have seen gains.

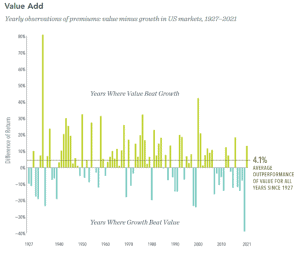

So, back to the tortoise and the hare. As of June 8, 2022, Small Cap Value is down 3.47% for the year while Large Cap Growth is down 20.64%. Data supports the principle that value stocks – with their lower relative prices – have higher expected returns. According to research from Dimensional Fund Advisors, on average, value stocks have outperformed growth stocks by 4.1% annually in the US since 1927.

*Source: Dimensional Fund Advisors

Last year, we suggested careful consideration when evaluating a portfolio heavily concentrated in the S&P 500. While value stocks spent 10 years lagging growth, current market performance highlights the benefit of patience. Diversification in a broad mix of all stocks – large and small, growth and value, US and international, and non-correlated investments – helps to smooth out returns over the long-term. Exercising the fundamentals of investing and leveraging data rooted in a century worth of evidence are critical when evaluating your portfolio. As Confucius said, “It does not matter how slowly you go so long as you do not stop.”

Schedule a conversation today with a CERTIFIED FINANCIAL PLANNER™ at Greenspring Advisors to discuss building your financial plan.

Information contained herein has been obtained from sources considered reliable, but its accuracy and completeness are not guaranteed. It is not intended as the primary basis for financial planning or investment decisions and should not be construed as advice meeting the particular investment needs of any investor. This material has been prepared for information purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance is no guarantee of future results.

Recent Insights