There appears to be a bright spot forming in the coronavirus conversation; a light at the end of our lockdown tunnel. These conversations begin with how and when our homes, businesses, and communities can return to normal. And naturally, they’ve grown into discussions on when our economy will not only rebound but, to borrow a slogan from President Harding, “return to normalcy.” Eventually, these conversations lead people to the proverbial alphabet soup used to describe the various shapes of economic recoveries.

V and U-shaped recoveries (or a combination of the two) to square root, L-shaped, and Nike Swoosh-styled recoveries. Terms like these populate headlines with little to no explanation or context for what they actually mean to average Americans. We thought it helpful to focus on and provide examples for the three most commonly referenced recoveries to help educate and explain what these terms actually describe. For this discussion, we have the good (V-shaped), the bad (U-shaped), and the ugly (W-shaped).

FIRST, THE GOOD – A V-SHAPED ECONOMIC RECOVERY:

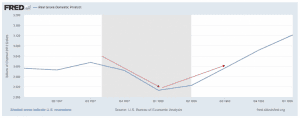

Good is really an understatement. When your economy has fallen off the deep-end with production unraveling, unemployment quickly rising, and markets being volatile, a V-shaped recovery is what economists hope and dream for. At its core, this type of recovery is quick and can happen over a matter of months. Following the 1957 recession is one of the better examples of a V-shaped recovery in the US.

While several economic data points helped push the US economy into recession during the latter stages of the year, including a nation-wide flu pandemic (H2N2) that killed an estimated 100,000 people in the US, the quick easing of monetary policy by the Federal Reserve, the expansion of state-based unemployment benefits through newly authorized federal assistance programs, and the acceleration of government infrastructure projects and funding helped get Americans back to work and the US economy back on track.

These actions, some of which aren’t dissimilar to the actions taken in response to the coronavirus pandemic, helped dampen the Eisenhower Recession severity. The sharp fall and equally quick recovery form a slight V-shape (highlighted by the red arrows below) in the chart of real GDP growth. Because of the Fed, Congress, and President’s quick actions, workers who had lost their jobs were able to find new ones quickly. Production recovered as nationwide construction began on the bridges and highways of America. And the economy was able to bounce back to positive growth within a matter of months.

NEXT, THE BAD – A U-SHAPED ECONOMIC RECOVERY:

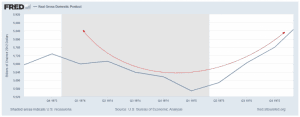

A U-shaped recession and recovery can be characterized by a gradual descent into recession with a somewhat symmetrical path to economic recovery. The gradual decline and subsequent recovery from a U shape in the path of Real GDP. The economic challenges faced by the US during the early 1970s provides a perfect example of this shape:

During this time, several factors influenced the economic contraction in the US economy. Amongst them was a sustained period of stagflation where both inflation and low economic growth persisted. The 1973 oil crisis and the US’s abandonment of the Bretton Woods system created additional economic shocks that presented obstacles to navigate during an already challenging time.

One interesting result of this specific recession was Congress’s adoption of the Federal Reserve’s dual mandate. Essentially, the Federal Reserve Act was amended in 1977 by Congress. The Fed’s result was to use monetary policy to promote maximum employment (target unemployment number) and keep prices stable (target inflation amount).

FINALLY, THE UGLY – A W SHAPED ECONOMIC RECOVERY:

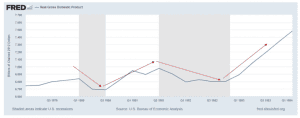

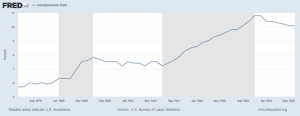

Imagine that the economy has just experienced a recession and quick recovery similar to our first V-shaped example. Unemployment, production, and other lagging economic indicators have started to trend towards normal. Economic activity is buzzing – but is still well short of the pre-recession capacity – and GDP is starting to grow again. As the economy picks up speed, the wheels start to wobble and eventually fall off. The economy drops quickly into another recession and starts the whole recovery process all over again. This recession-recovery-recession-recovery economic cycle is also known as a “double-dip recession” or W-shaped recovery. This type of recession is rare. In fact, there are only two modern examples of a double-dip recession for the United States: the recession of 1937-1938 and the recession of 1980-1982 (depicted below).

In this example, spikes in oil prices coupled with tight monetary policy helped plunge the US economy into recession starting in Q11980. While there were a modest recovery and pick-up in GDP in the latter part of 1980, with the help of tax cuts (which began the advent of Reaganomics), unemployment continued to provide added pressure on the recovery’s stability.

Again, as with all recessions, time was the best asset for the economy. After several quarters of slow GDP growth, the US economy eventually got back on the path to recovery and expansion.

THE PATH FORWARD

Given the vast number of unknowns and uncertainties that still exist, even as local and state economies begin to wake up from their self-imposed hibernations, we believe that the future path of the broader economy is not best represented by a letter or shape previously described in this post but by a question mark. There are too many variables that could impact the economy’s trajectory to know what type of recovery lies ahead. Or how long that recovery will eventually take. There are too many known unknowns to really say anything with any certainty.

But where there are great uncertainties and unknowns, the best asset we have for our clients and ourselves is time. The US has never failed to recover from an economic downturn. Before the pandemic, the economy showed every sign of continuing the longest expansion in history. The US economy was the strongest in the world before the pandemic. Hopefully, it will be the strongest coming out of it. As Warren Buffett highlighted in his annual meeting this year, never bet against America.

LAST THOUGHTS

In this discussion, there is an important distinction that should be made. The stock market, and its performance, do not represent the health of the broader economy. I repeat – the stock market is not the economy. The two may trend in the same direction over time but, one does not fully represent the other. In fact, there is a growing discussion about the disconnect between the major equity indices and the broader economy. That discussion has been top of mind for many market observers recently, including ourselves and our clients. It’s better served after gaining a deeper understanding of past economic recoveries.