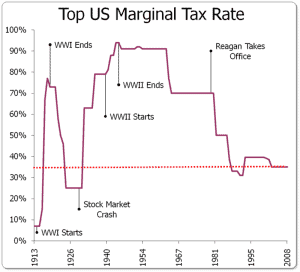

I often read articles that talk about the virtues of long-term tax planning. This could be in the form of Roth IRA conversions, charitable planning, or gifting strategies. In general, most of these articles are correct in their reasoning, but they tend to under-emphasize one important item: what may happen to the tax code over their planning period. The idea for this post came after I have been reading both the President’s and Republican plan for altering the tax code. Let me start by saying that both proposals have little chance of passing, but for those planning for future taxes, it should give us pause when arguing for long-term planning. These proposals have significant changes to how income is taxed. Changes in tax rates, deductions, or the different types of income being planned for can have a massive impact on tax planning in the future. Those that believe we will be in the same brackets 20 or 30 years from now should revisit their history books. For example, here is a chart of the top tax rate from 1913 to 2008:

Let this be a reminder that the tax code has undergone massive changes over the years and the odds are that this volatility will continue. We have found the best tax planning can be done over short periods of time 1-5 years, where we have some more certainty around tax rates. Also, “slam dunk” strategies tend to be situations when clients are in zero or shallow brackets and are expected to earn higher income in the future (or vice versa). Those can be ideal times to plan for client’s taxes. The only thing I feel reasonably certain about is that we all will be paying taxes in the future, and those that have/earn more will pay more. Other than that, it is hard to be certain about anything.