Have you ever felt intimidated by the markets? Thought that investing was only for brilliant people? Maybe you hear jargon like “beta,” “derivatives,” or “standard deviation,” and it just goes over your head? Contrary to what you may think, you can be the smartest person in the world and still be a terrible investor.

If I told you history’s most famous physicist failed miserably at investing, would you think differently? Sir Isaac Newton, the man who conceptualized three laws of motion, pioneered calculus, and discovered the color spectrum, among other accomplishments, was a terrible investor.

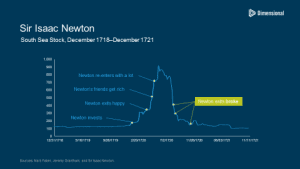

Setting—England, early 1700s. The South Seas Company is formed in anticipation of having a monopoly on trade to the Spanish colonies in South America after the War of Spanish Succession (1701-1714). The outcome of the War did not bode favorably for the company. Even though the company had completed no voyages to the new world after 5 years, its leadership turned to advertising false claims of success and wild (but false) tales of the company’s adventures.

During this time, Sir Isaac Newton invested in the company, watched the stock rise, and sold, making a handsome profit. Filled with greed and regret that he gotten out too early as he watched his friends make more money, he jumps back in, this time with an even bigger bet. Shortly after, the bubble bursts, and the sell-off begins. Newton loses most of his fortune and supposedly forbids anyone to utter the words “South Seas” in his presence ever again.

You might say that’s interesting, but that was also 300 years ago. Things are different today, and with the information and technology available to us now, this amusing tale of Sir Isaac Newton is no longer relevant. Many things about our world have changed since the days of Newton, but human nature has not.

Fast forward to the year 2000. Take the people with IQs in the top 2% of the population and see how they invest. Eleanor Laise did exactly that when she looked at the Mensa Investment Club’s investment performance between 1986 and 2001. She found that Mensa had a 2.5% average annual return. Compare that to the S&P 500, which had a 15.3% return during the same period. Not much has changed; after all, smart people can STILL be terrible investors.

We may have put a man on the moon, cured polio, and created the internet in the past 300 years, but we are still not immune to being terrible investors. If smart people can fail at investing, what does that mean for the average person? It means that you don’t have to have a top IQ or have invented the telescope (Newton pretty much did that too). It just means that you 1) need to invest for the long-term and not be swayed by the latest buzz, and 2) you need to be disciplined to ride out the inevitable ups and downs of the markets.