You may be asking yourself, “we are only a month into 2022, how could we have learned any lessons yet?”. While we may have just wrapped up January, it certainly feels like we’ve been through a whole year of news. We thought we’d share with you our views on what’s happening and the key takeaways for investors from the start of our new year.

Stock Market Volatility

The S&P 500 is down 10% through January 27th. Is this the beginning of a larger bear market or a short-term blip before we climb to new market highs? We wish we had an answer for you (unfortunately, we don’t believe anyone can predict the markets in the short term, at least with any persistency). The best we can do is to tell you about history. Here is what we know[1]:

- The stock market loses 5% about three times a year

- The stock market loses 10% about once a year

- The stock market loses 20% about once every three years

So, on average, drops of 10% only become 20% losses about a third of the time. Just because the market has fallen 10%, doesn’t mean it is going to keep falling. Because it is so impossible to time the markets, we continue to recommend maintaining a patient outlook, looking for tax-loss opportunities where available, but on whole, staying the course.

Inflation

This past December inflation (measured by the Consumer Price Index) hit an annualized rate of 7%. We haven’t seen that high of an increase since the early 1980s. There continues to be a debate raging amongst economists of whether this high inflation rate is transitory or here-to-stay. Rather than listening to the talking heads on TV, one thing we can observe is what the market thinks inflation is going to be over the next 5 years. We can do this by looking at the 5-year breakeven inflation rate (the difference in yield between inflation-protected bonds and nominal treasury bonds). As of December 31st, 2021, the market is predicting a five-year inflation rate of 2.87%. This is higher than where the breakeven rate has been the last 10 years, but it is nowhere near where the current inflation rate is hovering.

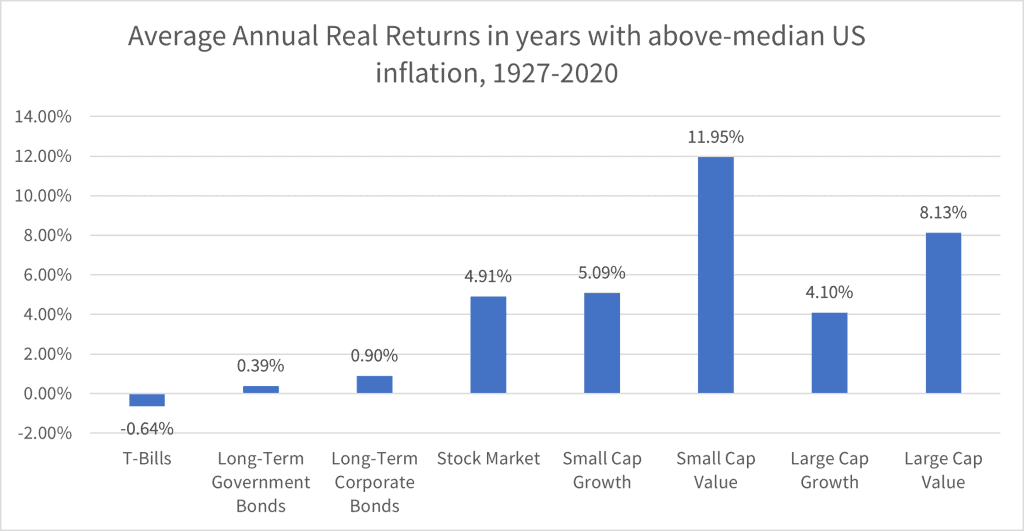

Nevertheless, it is important to have a portfolio that is prepared for higher than expected inflation. To that end, we have listed below asset class returns (after inflation) during periods when inflation has been above average[2]:

We see a few lessons to take away from this chart. First, inflation is not the boogeyman that many say it is; some inflation is necessary for a well-functioning economy. When only looking at periods of above-average inflation, almost all asset classes have positive returns after inflation. Second, different asset classes perform differently in high inflation environments. When looking at history, stocks outperform bonds, small companies outperform large companies, and value companies outperform growth companies. We’ll see that many of these historical trends have held up again as we enter 2022 with higher than average inflation.

High Tech/Crypto Collapse

There have been some spectacular collapses in 2022 in both the high-tech and cryptocurrency space. The darling of high-tech investing, Cathie Wood of Ark Investments, who at the end of 2021 predicted her funds to compound at 30-40% annually over the next five years, may be changing her tune. Year-to-date[3] her flagship ETF (ARK Innovation) is down 23% and has lost an astounding 58% from its high last February. In addition, Bitcoin, the most famous crypto investment, has generated similar results with year-to-date losses of 22% and is down 45% from its peak in November.

These losses may be temporary but there is a lesson to be learned from the rise and fall of these investments. Concentrating your assets in very specific areas of the market can be both rewarding and devastating. Hearing stories of investors who have all or most of their assets concentrated in these types of investments is concerning. If there is one thing we’ve learned over our years it’s that significant concentration in a particular asset class no matter what the asset class is (stocks, bonds, real estate, crypto, etc.) may eventually come back to haunt you.

Changing of the Guard

Perhaps the most interesting thing happening below the radar is some of the changing trends we are starting to see. No one knows if these are short-term aberrations or the start of a major change in market leadership, but it is worth noting.

First, when we look at major asset classes ranked from best to worst over the last 5 years we see a significant change of the guard so far this year. Those asset classes that have performed the best over the past five years[4] have gone to the back of the class in 2022:

| Asset Class | Benchmark | Last 5 yrs | 2022 YTD |

| US Stocks | Russell 3000 | 15.47 | -7.87 |

| Emerging Market Stocks | MSCI Emerging Markets | 7.83 | -3.28 |

| Real Estate | S&P Global REIT | 7.74 | -7.64 |

| International Stocks | MSCI World ex USA | 7.66 | -5.44 |

| Catastrophe Bonds | SwissRe Global Cat Bond | 3.61 | 0.05 |

| International Bonds | Bloomberg Global Aggregate | 3.19 | -1.42 |

| US Bonds | Bloomberg US Agg Bond | 3.11 | -2.13 |

| Energy Pipelines | Alerian MLP | -2.14 | 10.02 |

In addition, as we look at the stock market a bit more closely, we see a massive change in sector performance when dissecting the stocks in the major markets around the world:

| Factor | Benchmark | Last 5 yrs | 2022 YTD |

| US Value Premium | Russell 3000 Value minus Russell 3000 Growth | -10.72 | 7.88 |

| Int’l Value Premium | MSCI EAFE Value minus MSCI EAFE Growth | -5.10 | 12.92 |

| EM Value Premium | MSCI EM Value minus MSCI EM Growth | -4.49 | 2.72 |

Growth stocks have been driving the market higher over the past five years, as evidenced by the negative value premiums (when the value premium is negative growth stocks are outperforming value stocks). Companies like Amazon, Tesla, and Google have generated significant returns these last few years with earnings and valuations soaring to new heights. That seems to have turned so far in 2022. Interestingly, over the last 95 years, value stocks have outperformed growth stocks in the US by about 2% per year, so the changing of the guard as it relates to value outperforming growth is not something we are necessarily surprised by.

Conclusion

The only thing we are certain of is more uncertainty. The great thing about investing is that you don’t need to know the future to be successful. Developing and sticking with a diversified portfolio that can weather any market conditions continues to be the best strategy we know of generating returns that can meet your objectives.

Please reach out to us if you have any questions about this data or your specific portfolio.

______

[1] Capital Group, A History of Declines (1951-2020)

[2] Wei Dai, Mamdouh Medhat- US Inflation and Global Asset Class Returns, July 2021

[3] 1/1/2022 through 1/27/2022

[4] Data Source: Morningstar Advisor. The last 5 years and 2022 YTD performance figures are through 1/28/2022