This question is pretty common amongst our clients we meet with. They may have built up cash over time, sold a real estate property, or inherited money. Whatever the reason, they find themselves sitting on cash and are fearful of investing it in the stock market for what could be a host of reasons (valuation of the market, current geopolitical issues, or a recent run-up in equity prices are just a few). This is probably the reason they are actually still sitting on cash! They are fearful about a correction in the market and have found it safer to sit on the sidelines.

One of the problems with this thought process is that you actually assume you’ll invest AFTER a crash. No one rings a bell at the top or bottom, so it is hard to know when to invest after the crash. Many might think they’ll wait until the market goes down 25% (or some other arbitrary number), but there are many instances where the market keeps dropping. Also, the bottom of the market is almost always at maximum pessimism. It’s hard to find many investors who have the stomach to invest heavily when the news and future outlook are at their worst.

Let’s assume you do have the stomach to invest after a market correction. Here is the bigger issue that most investors don’t think about- there is almost always a cost to wait. You may be able to invest after a correction, but what if it takes 2 years actually to experience the correction? You may have missed out on significant gains in the meantime. Research shows exactly this happens. From 1926 to 2016, the US stock market returned 6.3% over cash. This same research looked at investors who waited to invest until a correction occurred, then measured their returns 5 years after those corrections (period measured included waiting period, crash, then 5 years after crash). Those that were disciplined enough to stay in cash until a correction happened, then put it all in the market for 5 years generated returns that were, wait for it…about half of those they would have received if they just held stocks throughout the whole period.

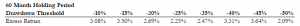

Here is the chart from the research- remember excess returns are returns over cash (buy and hold average is 6.3%)

It doesn’t matter if you wait for 10% correction or 50% correction. The odds are against you if you are waiting for a market correction before your invest.

So how should you move forward if you are sitting on cash to invest? The strategy that yields the highest historical returns is to invest it all in the market today. For someone holding cash because they are fearful about a correction, that is about the scariest answer they can hear. It is also important to note that while that strategy may have the highest return potential, it also has high risk. A more balanced strategy would be to dollar-cost average (invest a set amount over a specific number of periods) into the market. This works because if there is a market crash, you can invest at least some dollars at lower prices.

There is not a right answer as to whether you invest it all now or dollar-cost average. That is more a question regarding your risk tolerance. One of our core values is to “Trust the Evidence.” While waiting for a correction before you invest may “feel” like the best course of action, the evidence suggests this is not a sound investment strategy.