We discussed how basic math confirms that an average active manager ALWAYS underperforms its passive counterpart in an earlier post. The keyword in that statement is average. A few managers will outperform their passive brethren each year, even though the average manager will underperform. I promised to revisit this in a future blog post to discuss whether we could determine if the outperforming managers were skillful or just plain lucky.

I find it interesting that consultants and advisors in our industry tend to talk about a manager’s skill after a period of outperformance. After several years of outperformance, consultants conclude that this manager is not merely lucky but skillful. It is pretty common for consultants to want a 3-year track record in the institutional world before they would consider recommending an investment to a client. But how long does a manager need to exhibit outperformance before we are sure they are actually skillful rather than just lucky? It is a fundamental question since random chance tells us that a fairly high number of managers will outperform.

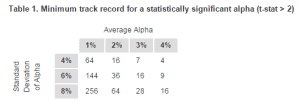

In a paper written by Brad Stein, called “The Paradox of Skill,” he identifies how long of a period you would need to see outperformance of a manager before you could conclude they were skillful (and not just lucky):

Alpha is a measurement of outperformance over a benchmark. The t-stat tells us the statistical significance. So, if you have a manager that has outperformance (alpha) of 1% per year and the volatility of that outperformance is minor (4% standard deviation), it would take 64 years before you could be sure that the manager was skillful! The more likely scenario is the manager with outperformance over long periods of time, but that outperformance is very lumpy (some periods they significantly underperform and others outperform). A good example of that would be a manager with a 3% alpha (which is a huge annual outperformance) and an 8% standard deviation. You would need to see this type of outperformance for 28 years before being confident that you had a skillful manager.

As you can see, consultants and advisors in our industry really don’t understand statistics. After it has had 5 or 10 years of success, recommending an investment strategy is paramount to saying a coin flipper will flip heads a fifth time because the first four were heads. Random chance (luck) tells us that managers can and will outperform. This research also tells us that it takes an extremely long time to be sure that outperformance is actually due to skill versus just getting lucky.