In Part II of our ESG Series, we talked about how hard it is to measure whether ESG investing really makes a difference. This time we are going to try to answer another important question: Do I have to sacrifice returns if I pursue ESG investing?

The answer is…not necessarily. It is a difficult question to answer due in large part to the issues identified in the previous blog related to the variations in ESG data and metrics, or, in other words, the various flavors of ESG. Despite these challenges, we decided to investigate further.

First, let’s go to the smart people- the academics. In a recent research paper published in November 2021, three finance professors from Arizona State University concluded that “ESG investing has essentially no cost for systematic investors.” Basically, ESG investing is a net neutral. If we add some investment terms to the alphabet soup, the study found that ESG had no effect on the alpha (ability to beat the market), beta (volatility compared to the overall market), and Sharpe ratio (the risk-adjusted return) of a portfolio.

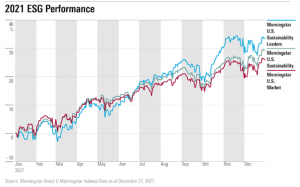

Not a fan of investment jargon and ratios? Let’s look at last year and see if that tells us anything. While acknowledging the current shortcomings in ESG data, we can refer to one of the most widely recognized industry benchmarks, the Morningstar US Sustainability Index. Morningstar uses the term sustainable in the more historical context to broadly mean a long-term approach to responsible investing that incorporates ESG factors. The Index, comprised of 373 companies, returned 29.1% in 2021, 3% better than the overall U.S. stock market. If you then take the top 50 most sustainable companies and look at the Morningstar U.S. Sustainability Leaders Index you will see a 2021 return of 33.3% which is 8% higher than the performance of the broader U.S. market.

2021 ESG Performance

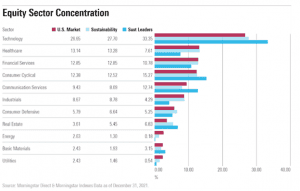

Now before you go bet the farm on ESG investments because you are looking for outperformance, let’s dig in a little deeper. Big tech names tend to be heavily overweighted in this index. Companies like TESLA and MSFT have almost twice the weight in the Sustainable Index than they do in a conventional index while the tech company Nvidia’s weight is almost three times greater. In 2021 Nvidia was up 125% and had an outsized impact on the sustainable index. Imagine the impact though had Nvidia been down 50%? The chart below illustrates where the Sustainability Index overweights certain sectors compared to the broader US Market.

Equity Sector Concentration

Let’s widen the lens and look not just at 2021 but at the last 30 years. Below is a chart of the MSCI KLD 400 Social Index that was launched in 1990. MSCI acknowledges that the methodology and some of the key inputs have changed over time but it is one of the best long-term measures for ESG investing that we have today. The chart illustrates that the ESG approach has mirrored and slightly outperformed the broader US Index over time.

So where does that leave us? The academics tell us that ESG investing does not impose an additional cost to a portfolio. Recent performance tells us that ESG can look really good or conversely, has the potential to look really bad based on how a handful of stocks perform. Long-term data is limited but indicates that ESG investing does not detract from returns.

The answer to whether one should pursue ESG investing is a personal one that should reflect your own goals and values. Or you can look for the answer in your bowl of soup.

Greenspring provides ESG options for clients aligned with our overall investment strategy of focusing on low-cost, globally diversified portfolio. If you have an interest in learning more about ESG investing contact us today.

To read the full series click below:

Learning to Invest Responsibly: What is ESG?

ESG Investing Part II: Does It Really Make a Difference?