Inflation, often referred to as “the hidden tax”, is the thief in the night that slowly erodes the value of those hard-saved dollars. If you are retired and living on a fixed income source like Social Security and/or a pension, you are most vulnerable to inflation and its impact on your lifestyle. While we cannot control inflation directly, we can help mitigate its effects by developing a plan and adjusting along the way. Here are three things to consider:

Personal Inflation Rate

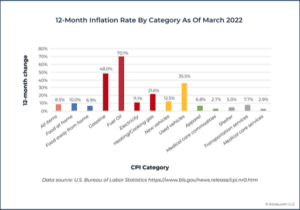

The headline inflation rate rose to 8.3% in April, hovering near a 40-year high. While the headline inflation may be jarring, your personal inflation rate is likely much different. The headline inflation rate considers housing costs, transportation, and education, among other things. A retiree who owns their home, does not often travel or commute daily, and does not intend to pay for school, has a much different personal inflation rate. Inflation assumptions are a crucial input within any financial planning you do. Considering your personal inflation rate through a year-over-year budget analysis will help you develop a more accurate retirement picture and identify any necessary spending adjustments.

Portfolio Diversification

As you approach retirement, you have likely made efforts to dial down risk in your portfolio to favor stability over growth. This is a sensible approach, but not without consequences. Fixed income portions of portfolios are the most affected during high inflationary times because the purchasing power of the interest payments and principal you receive erodes. While bonds in a portfolio should be of high quality and shorter duration to mitigate the effects of rising rates that have traditionally followed high inflation, it is also important to consider alternatives to traditional fixed income within your portfolio. When considering alternatives, they should have similar risks as your other fixed income sources but not be correlated (i.e., they earn their return a different way). Alternatives such as Treasury Inflation Protected Securities (TIPS), I-Bonds, Reinsurance, and Direct Lending can offer alternatives that bolster the risk/return within your portfolio and serve as a hedge against inflation.

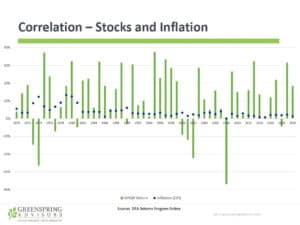

On the riskier side of the investment spectrum, stocks have been good hedges against inflation over the long term, with small/value stocks performing the best. While no correlation exists to suggest that high inflation precipitates positive stock returns, the average rate of return of stocks has far surpassed that of the average inflation rate, and evident in the bar graph below. Retirees need to understand that while retirement feels like a finish-line, you potentially have another 40 years where you will be an investor and may benefit from having exposure to stocks within your portfolio as nothing more than a hedge against inflation.

Cash Management Techniques

Stashing cash under your mattress or in a savings account yielding near zero (although rising) is not an effective way to outpace this historical inflation. Historically, the markets have rewarded long-term investors. Multiple studies reflect that it would take $14 dollars today to purchase $1 of goods in 1929. If you had placed that $1 under your mattress in 1929, it would still be worth only $1 today. So, if stocks and alternative fixed income sources have been a good hedge against inflation, putting these dollars to work by getting fully invested likely puts you in the best position to mitigate inflation. Start by identifying your cash needs and place a dollar amount on each. Ensure you have enough cash on hand to cover these goals, and any excess could be directed to the portfolio. This allows you to have the cash needed to meet your near-term goals while not leaving anything on the table in the way of return.

Leaders of the Federal Reserve have a long-term target of about 2% inflation, suggesting that the inflation we are experiencing today will be short-lived. However, any amount of inflation will have an impact on a retiree. Ensuring you are fully invested in a diversified manner, having a good understanding of your cash needs, and understanding your personal inflation rate can help to mitigate the effects of high inflation and give you a better understanding of its impacts on you.

Would you like a schedule a call now?

You can get started now by booking an appointment with a financial advisor.

Information contained herein has been obtained from sources considered reliable, but its accuracy and completeness are not guaranteed. It is not intended as the primary basis for financial planning or investment decisions and should not be construed as advice meeting the particular investment needs of any investor. This material has been prepared for information purposes only and is not a solicitation or an offer to buy any security or instrument or to participate in any trading strategy. Past performance is no guarantee of future results.

Recent Insights

Fleeting Fad or Future Fortune – The New Bitcoin ETFs are Here

Tax Drag: Picking Up Nickles