At Greenspring Advisors, we believe our role as a fiduciary advisor, from a pure investment standpoint, is to help retirement plan committees make investment decisions that simplify the decision-making process for participants and provide them with the greatest ability to build a low-cost, well-diversified portfolio that addresses their individual needs and keeps them invested in both good and bad times in the market. Our investment philosophy for defined contribution plans focuses on two areas: Investment Selection/Due Diligence and Fund Menu Design.

To do this, we work closely with retirement plan committees to determine the most appropriate asset classes that should be represented in the plan’s core investment lineup based on the demographics of their employee population while simultaneously streamlining the complexity often faced by plan participants. Once these decisions have been made, we believe our value is in helping the committee consistently follow a disciplined investment process as outlined in the investment policy statement regarding the selection, monitoring, and replacement/removal of the individual fund options.

As a firm, we embraced an “evidence-based” approach to investing since we opened our doors in 2004. Despite beginning my career working for a major brokerage firm where I was indoctrinated with the idea that active management was the only way to invest, I had actually started to use exchange-traded funds (ETFs) clients on a minimal basis while still working there. This was in the early days before the dramatic rise in popularity of these investment vehicles, but there was something about low-cost index investing that made sense to me.

After we left to start Greenspring, we were introduced to a robust body of research that we had never been exposed to at our prior firms. And the evidence we encountered compelled us to go “all in” on passive management for both our corporate retirement plan and wealth management clients. It was like Neo taking the red pill in The Matrix.

Passive vs. Active Management

“Passive” management (often referred to as “indexing”) is actually not a great descriptor, so let me quickly explain the difference between this style of investing and the traditional approach often referred to as “active management.”

The primary goal for active managers is to beat the market by taking advantage of pricing “mistakes” and attempting to predict the future. In essence, this approach to investing is predicated on the idea that markets are “broken.” It can be exploited by portfolio managers and research analysts who can consistently outsmart the millions of other investors they are competing with daily (i.e., the market). Unfortunately, investing is a zero-sum game, and too often, this approach proves costly and fruitless. Predictions don’t come to fruition, and managers miss the strong returns that markets provide by holding the wrong securities at the wrong time.

Alternatively, passive managers essentially accept that markets are “efficient,” which means they incorporate all available information. Trying to forecast or outguess the millions of other investors who make up the market is costly and futile. Instead, passive managers generally try to track the returns of a particular market index or benchmark as closely as possible instead of outperforming it. Generally, the difference between the return of the index and the fund’s return is the fund expenses. To be clear, indexing and passive management are often not always the same while often used synonymously. For instance, all index funds could be considered passively managed, but not all passively managed funds are considered index funds. But that is a topic for another day.

Examining The Evidence

Instead, let’s shift gears and take a look at the evidence for passive investing. I want to start by stating that I believe most retirement plan committees and the investment consultants/advisors they use to focus on factors and criteria that have been shown to have little or no predictive ability in determining future investment returns (e.g., speculation, predictions, market timing, manager selection, etc.).

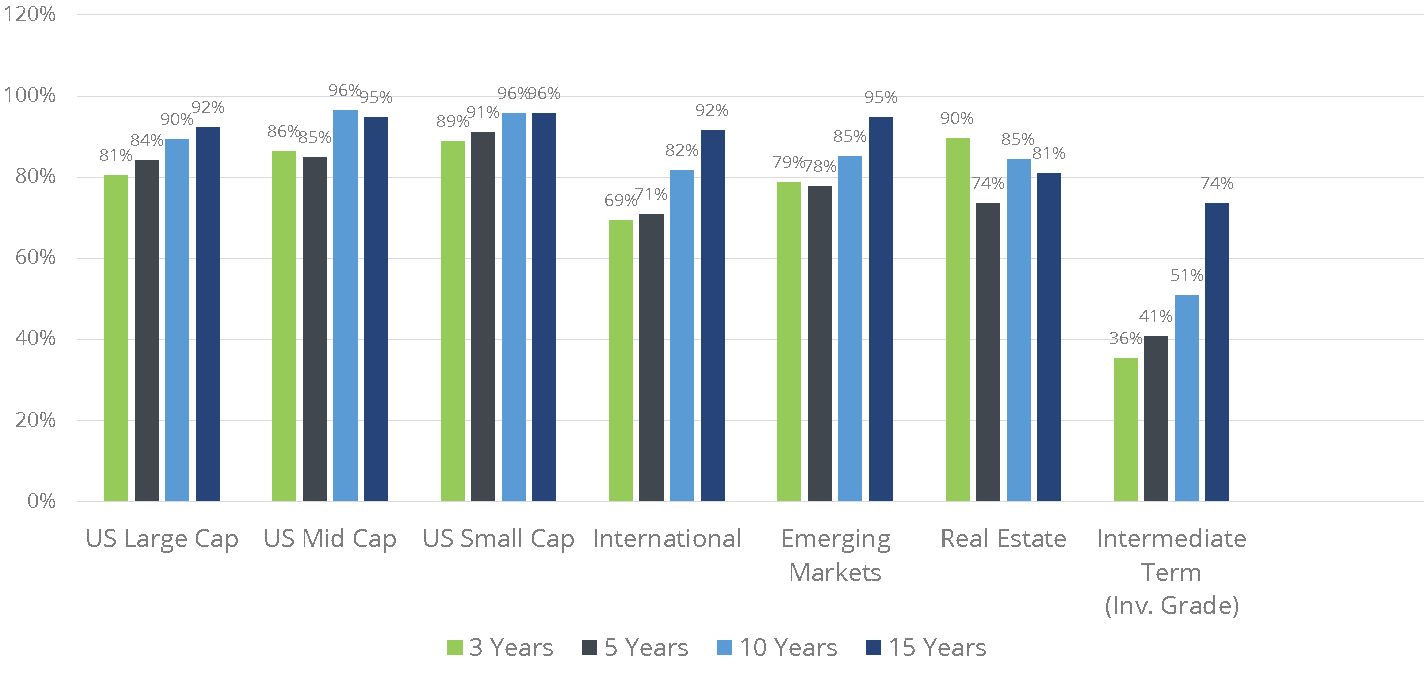

Significant amounts of empirical data show that most active investment managers fail to outperform their respective benchmark index on a year-to-year basis due to factors such as poor security selection, failed market-timing strategies, and high costs. The chart below shows the percentage of actively managed equity funds by asset class that failed to beat the index over the previous three-, five-, ten, and fifteen-year time periods, ending December 31, 2017. Except for Intermediate-Term Bond Funds over the three- and five-year periods, most active funds failed to outperform. For instance, over the past 15 years, 92% of U.S. large-cap funds, 95% of U.S. mid-cap funds, and 96% of small-cap funds have failed to beat the benchmark for its asset class. It doesn’t get any better using active funds that invest outside the U.S., as 92% of international funds and 95% of emerging funds have also failed to beat the index over that same period.

The Failure of Active Management

Percentage of Active Public Equity Funds that Failed to Beat the Index 3, 5, 10 and 15 Years as of December 2017

Source: Standard & Poor’s Indices Versus Active Funds Scorecard (SPIVA), Year-End 2017.

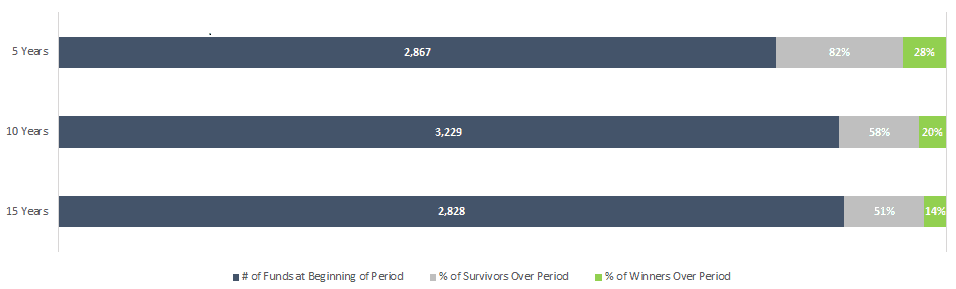

The case for active management in both equities and fixed income is equally unfavorable when reviewing the long-term investment horizons’ performance. Additionally, funds disappear at a meaningful rate, a concept known as survivorship bias or the tendency for mutual funds with poor performance to be liquidated or merged by mutual fund companies, generally because of poor results or low asset accumulation. This phenomenon, which is widespread in the investment industry, results in an overestimation of the past returns of mutual funds.

The charts below show both the survivorship and the “success rate” of equity and fixed income mutual funds over 5, 10, and 15 years, ending December 31, 2017. There were 2,828 equity funds and 1,599 bond funds, respectively, in the sample at the beginning of the period. During that time, the success rate (i.e., funds that existed the entire 15-year period and beat their respective benchmarks) was only 14% for equity funds and 13% for bond funds. Further, at the end of the period, approximately one-half of the funds in each asset class remained in existence for the full fifteen-year period.

Few Equity Mutual Funds Survive and Beat Their Benchmarks

Performance period ending December 31, 2017

The sample includes funds at the beginning of the five-, 10-, and 15-year periods ending December 31, 2017. Survivors are funds that had returns for every month in the sample period. Winners are funds that survived and outperformed their respective Morningstar category benchmarks over the period. US-domiciled open-end mutual fund data is from Morningstar and the Center for Research in Security Prices (CRSP) from the University of Chicago. Past performance is no guarantee of future results.

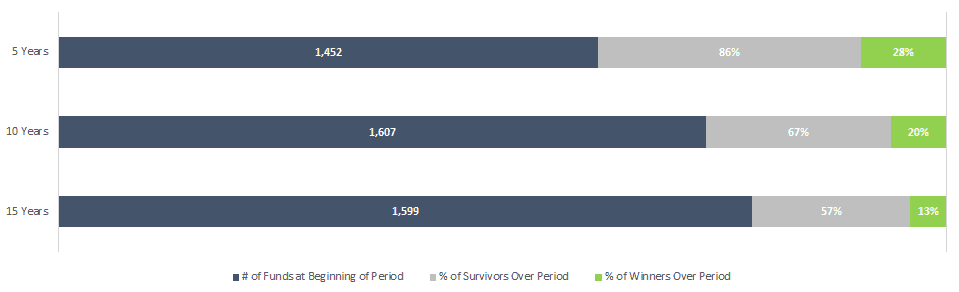

Few Fixed Income Mutual Funds Survive and Beat Their Benchmarks

Performance period ending December 31, 2017

The sample includes funds at the beginning of the five-, 10-, and 15-year periods ending December 31, 2017. Survivors are funds that had returns for every month in the sample period. Winners are funds that survived and outperformed their respective Morningstar category benchmarks over the period. US-domiciled open-end mutual fund data is from Morningstar and the Center for Research in Security Prices (CRSP) from the University of Chicago. Past performance is no guarantee of future results.

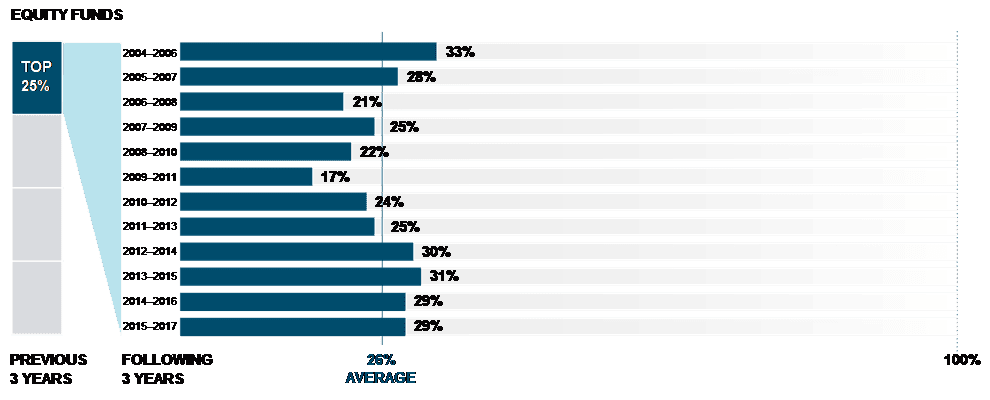

With thousands and thousands of funds available for purchase within the marketplace, trying to find those precious few that will outperform is a tough job. Many investors and committee members (as well as most advisors/consultants) focus on funds with strong track records. Assuming past performance is evidence, these managers will continue to outpace their benchmarks (despite all the compliance disclaimers to the contrary!).

But is this assumption backed by reliable evidence? The data suggest otherwise. The chart below illustrates the lack of persistence in outperformance through 12/31/2017. At the end of each year, equity funds were sorted within their category based on their five-year total return. The tables show the percentage of funds in the top quartile (25%) of five-year performance ranked in the top quartile of one-year performance in the following year. For example, in 2017, only 29% of equity funds were ranked in the top quartile of performance in their category in both the previous period (2012–2014) and subsequent period (2015–2017).

Do Winners Keep Winning?

Percentage of funds that were top-quartile performers in consecutive three-year periods

US-domiciled open-end mutual fund data is from Morningstar and the Center for Research in Security Prices (CRSP) from the University of Chicago. Past performance is no guarantee of future results.

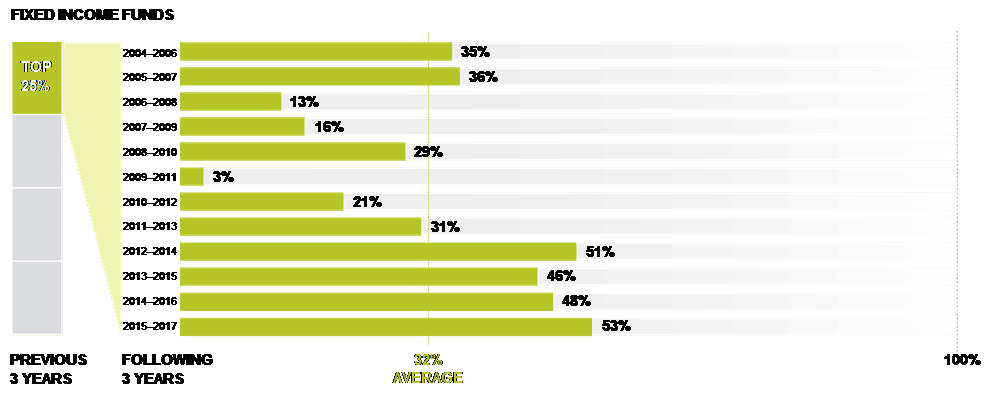

Similar data are observed about fixed income.

Do Winners Keep Winning?

Past performance vs. subsequent performance—fixed-income funds

US-domiciled open-end mutual fund data is from Morningstar and the Center for Research in Security Prices (CRSP) from the University of Chicago. Past performance is no guarantee of future results.

Given the data, we believe the emphasis that retirement plan committees place on hiring an advisor/consultant that can identify managers who will “beat” or “outperform” the market is misplaced at best and disastrous at worst. At Greenspring, we acknowledge that there will, in fact, be a relatively small number of managers who outperform over time. We do not believe that any advisory firm, regardless of the resources at their disposal, can consistently identify those managers ahead of time who will outperform in the future with any reliability. That includes our firm.

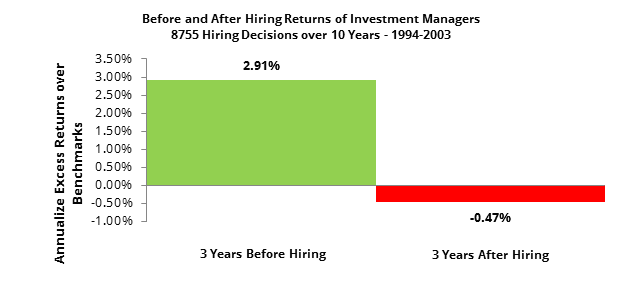

Most advisors/consultants are loathed to admit this. However, to support this idea even more fully, I would refer you to the study from May 2005 by Amit Goyal and Sumit Wahal entitled The Selection and Termination of Investment Management Firms by Plan Sponsors. The study evaluated 8,755 hiring decisions over a 10-year period (1994-2003). On average, the pension funds surveyed in this study chose managers who generated significant excess returns over their benchmark index in the three years immediately before hiring, only to find that they could not replicate this outperformance in the corresponding future three-year period. Again, the data show that past performance has little relevance on future returns and committees, and their consultants have not avoided this trap. The data from the study are presented below:

One of the areas we think can have an important impact on future outperformance, at least from a peer group standpoint, is costs. For instance, in 2002, mutual fund industry insiders hired Financial Research Corporation (FRC) to complete a study to find a predictor of future fund performance. The study, Predicting Mutual Fund Performance II: After The Bear, measured ten “predictors” (e.g., past performance; Morningstar ratings; expenses; net sales; asset size; risk/volatility measures), and the findings showed that most of the statistics had no predictive value. The study did, however, find one reliable predictor—expenses. Funds with lower expenses delivered “above-average future performance across nearly all time periods.” FRC concluded that a favorable expense ratio is an “exceptional predictor” for bonds and a “good predictor” for stock funds.

Also, in a 2010 article research report entitled “How Expense Ratios & Star Ratings Predict Success,” Morningstar concluded that:

“If there’s anything in the whole world of mutual funds that you can take to the bank, it’s that expense ratios help you make a better decision. In every single time period and data point tested, low-cost funds beat high-cost funds. Expense ratios are strong predictors of performance. In every asset class over every time period, the cheapest quintile produced higher total returns than the most expensive quintile. Investors should make expense ratios a primary test in fund selection. They are still the most dependable predictor of performance. Start by focusing on funds in the cheapest or two cheapest quintiles, and you’ll be on the path to success.”

Ironically, investment performance actually plays a small role in driving successful retirement outcomes for participants, even though retirement plan committees and advisors/consultants focus heavily on this area. Instead, factors like plan design and plan contributions are much more important drivers of retirement sufficiency. This doesn’t mean that having a robust investment selection and monitoring process is unimportant or unnecessary. On the contrary, ERISA mandates the need for this. However, I believe retirement plan committees would be well-served to embrace a low-cost, passive investment approach and shift their time and effort to areas that move the needle for their participants in a more significant way.

If your committee wants to learn more about evidence-based investing and how this can benefit your plan and your participants, feel free to connect with our team to begin a conversation.