With offices (and therefore clients) in Maryland and New Jersey, we often have clients ask us about the best states to retire in from a tax perspective. While clients think about how much income tax they’ll have to pay in retirement, we have found that the calculation is much deeper. First, as clients retire, their income typically drops substantially. Even if tax rates are high, if their income is fairly low, the differential to move to Florida or some other state with a low-income tax rate may not be worth the effort of moving.

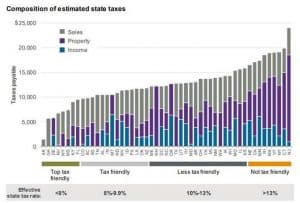

JP Morgan1 did some interesting work on this topic and analyzed states based on the three major taxes retirees will face: sales taxes, property taxes, and income taxes. Surprisingly, for many high tax states, property taxes consume the majority of their overall tax liabilities. While there are many assumptions listed below in their analysis, we found this chart to help understand how states tax their retiree populations (click on the image below to enlarge):

Here are a few important takeaways:

- Every client is custom– do you have a large home? Is your pension going to put you in a high bracket? Do you have a large IRA that is going to generate significantly required minimum distributions? All these questions change the calculus of which state will be advantageous to move into.

- Go deeper than income taxes– in Maryland, many pre-retirees talks about moving to Pennsylvania because they do not tax pensions or IRA contributions. While it is true, it may be lower income taxes than Maryland; the differential is not nearly as great as many believe when you factor in sales taxes and property taxes.

- Don’t let taxes be a primary decision of where you live– while I believe many people understand this point; it is hard to put a price tag on being close to family and friends, climate, and living in a community that you enjoy. For that reason, taxes should be just one of many factors you consider on where you want to spend your retirement years.

1 Roy, Katherine, et al. “J.P. Morgan Guide to Retirement, 2018 Ed.”

Disclosure specific to the J.P. Morgan chart: MODEL ASSUMPTIONS Scenario based on retired married couple filing State income tax on1 jointly: • Annual retirement plan distribution: $80,000 • Total Social Security benefits: $42,000 Property tax on2: 2.5x median home value by state Sales/average local sales tax on3: Remaining income net of federal & state income and property tax. Retired married household age 65. 1 State income tax liability is based on all taxable retirement income sources minus allowable state personal exemptions and a standard deduction. State-specific exemptions, deductions, and/or credits related to eligible retirement income and Social Security are included. States with no income tax: AK, FL, NV, SD, TX, WA, WY. States that tax interest and dividends only: TN and NH. States that tax Social Security: CO, CT, KS, MN, MO, MT, NE, NM, ND, RI, UT, VT, WV. States that do not tax retirement plan distributions or Social Security: IL, MS, PA. 2 State property tax applies to home value only and includes state-specific homestead exemptions/credits. 3 States with no sales tax: AK, DE, MT, NH, OR (local taxes may apply). Of note: CA imposes a 1% surtax on taxpayers earning more than $1M ($1,074,996 married) for a top marginal tax rate of 13.3%. NYC levies an additional 3.078-3.876% on taxable income. From 2018 to 2025, certain New York tax rates will be incrementally reduced. HI, top marginal income tax rate reduced to 8.25% in 2017 and increased to 11% in 2018. Illinois tax rate increased to 4.95% on all income in 2018. Source: J.P. Morgan Asset Management. This slide’s presenter is not a tax or legal advisor, and this slide should not be used as such. Clients should consult a personal tax or legal advisor before making any tax- or legal-related investment decisions.