You may recognize the quote in the title from the movie Anchorman. If not, here is the clip to refresh your memory:

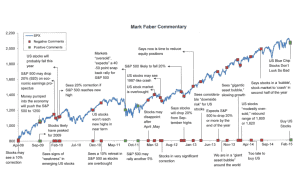

This can be a lot like stock pickers, pundits, and TV personalities. Except for the percentage of the time, they are right are usually way under 60%. A man like Marc Faber fits it to this camp. For some reason, he continues to get TV time with headlines like this one: Marc Faber: S&P is set to crash 50%, giving back 5 years of gains. At first blush, this sounds pretty scary. That’s the main reason CNBC is publishing it. They know that fear sells, and you are much more likely to watch a clip about a major market crash than something much more useful like diversification, cost management, or tax minimization. Unfortunately, no one seems to check their contributor’s actual results (who really cares about the data anyways?). Here is a great chart showing Marc Faber’s record over the last 7 years:

He seems to predict a market crash as often as a meteorologist predicts rain. Of course, at some point, he’ll be right. The only problem is that if you continue to follow his advice, you’ll most likely be broke before this happens. This post is not meant to insult Marc Faber but to illustrate the folly of predictions. This is just another example to run (not walk) away from anyone who is using prediction for the basis of advice. It may seem like making changes to your portfolio based on predicting what stock will do well or whether the market is high or low makes sense, but nothing could be further from the truth. Base your investment strategy on evidence and logic, and all of this stuff becomes noise.