Wouldn’t it be great if investors could navigate the markets as we navigate through traffic- -guided by red, yellow, and green lights? If we had signals that told us with certainty what direction the economy was headed, we might have an edge in our investment strategy; we would know when it was a good time to invest when to proceed with caution or put the brakes on.

Unfortunately, the reality is that the market is murky and unpredictable. As the economist, Paul Samuelson once put it: “The stock market has called nine of the last five recessions.” The market marches to its own drummer, or rather too many drummers, as it processes information from millions of investors about whether they want to buy or sell a stock.

This year, when US Equities were down 10% much thought, this was the first sign of impending doom for the economy. Well, we all know what happened. By the end of the quarter, the market had recovered from losses and entered positive territory. Although the economy is not without some areas of concern, it turns out wages are rising, corporate profits continue to be healthy, and inflation remains tame.

But if anything could shed light on the future of the economy, wouldn’t the stock market be the most logical place to look? Shouldn’t we check a benchmark index like the S&P 500, which has come to define the US stock market, and gain some helpful insights? No, says Julieta Jung, Ph.D. in Economics, who researches to inform policymakers and aid discussion at the Federal Reserve’s Dallas District.

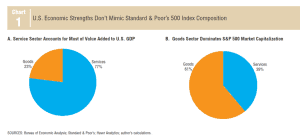

Ms. Jung points out in a recent Economic Letter to the Federal Reserve Bank of Dallas that Indexes such as the S&P 500 are flawed mirrors of the economy and therefore fail to predict GDP. She notes that half of the components in the S&P 500 are manufacturers, but when you look at US GDP, service providers account for more than ¾ of GDP output. Also, the stock market and the economy react very differently to shocks. The market can turn on a dime when unanticipated news or events occur until investors digest what has happened. In contrast, households and businesses adjust to the same news much more slowly.

So what is an investor to do if she is uncertain about the economy’s direction and not sure if it is a good time to invest? First, understand that the stock market is not the economy, and there is no reliable signal that can tell you it is a good, bad, or indifferent time to invest. Second, understand that your portfolio needs to be designed to match your tolerance for risk so you can stay invested through the inevitable ups and downs. Third, and most importantly, do what we constantly tell our clients to do- -focus on things you can control. We can’t control what the market will do, but we can control certain things such as costs, taxes, investment discipline, and portfolio allocation. Our advice: Focus on these areas that will have a meaningful impact rather than decipher market gyrations.