A commonly held belief in the investment world is that active management works better in inefficient markets where there is less information available (e.g., small-cap, international, emerging markets, etc.). The theory usually suggests that this market inefficiency creates managers’ opportunities through superior security selection to achieve outperformance.

First, we know of no statistical or empirical data that support this commonly held belief. Here is a discussion with Kenneth French(economics professor at Dartmouth) discussing this very topic.

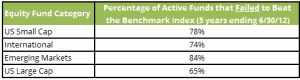

In addition, if this argument were true, you would expect to see Small Cap, International, and Emerging Market managers outperform their benchmark indices due to the perceived inefficiencies in these markets. Here is the actual data from the Mid-Year 2012 S&P Indices Versus Active Funds Scorecard (SPIVA):

Interestingly, the best performing asset class against its benchmark index was large-cap US stocks. Since most would consider this to be the most efficient asset class of the four, the argument that active management is desirable within inefficient markets is not supported by the data.